|

Our

Strategic Plan is for investors interested in

trading once in a while.

-

+29% YTD.

-

In cash most of the time.

-

Only begin trading

5 minutes after the open.

-

This Strategy trades around long term

pivots only.

-

We do not fire

alerts. You need to know the rules.

-

We trade

two ETFs: DDM and DXD

-

Risk controls are

integral.

-

Designed for

1-3 month trades.

-

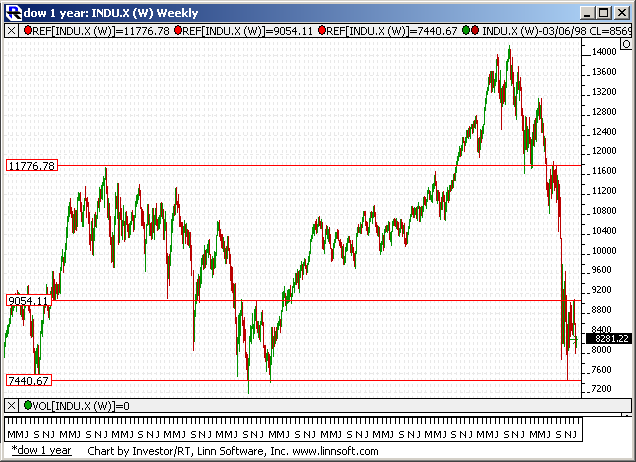

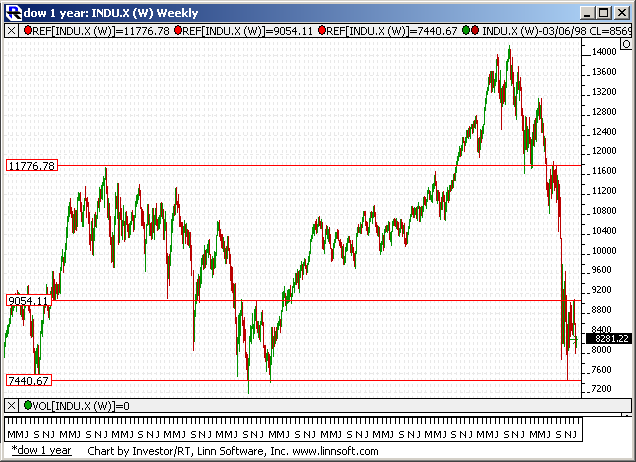

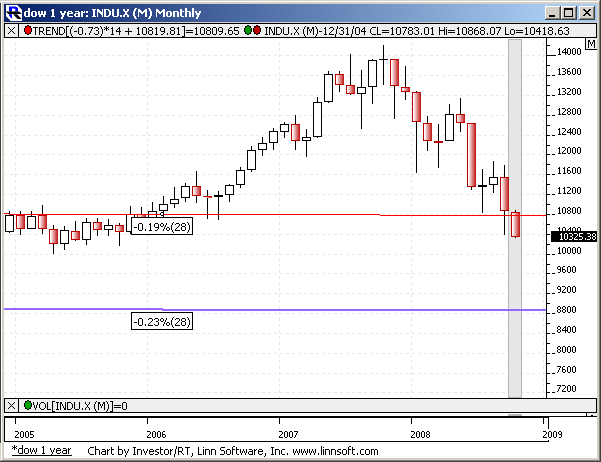

The graph below shows the growth of $100K in

this strategy.

The

Current Dow Parameters for the Strategic Plan are:

6485 - 9083 - 9904 - 10725 - 11724

Our Strategic Plan

averages a few trades per month. This is a

conversion strategy. That means it is a proactive

long/short strategy that will convert from short to

long, or from long to short, based on tests or breaks of

support or resistance levels. Those are our risk controls,

and they

are integral. Once the Market makes up its mind,

we ride it in either direction to secure gains.

The end results show a few small stops associated with a

much larger gain most of the time. This strategy is based on the Dow Jones Industrial

Average, and it trades DDM and DXD exclusively.

Although it can make money on the short side of the

market, it is never short anything because DXD is a

short ETF that we buy. That opens it to qualified

accounts.

Based on a strict set

of rules, this strategy has performed well over time.

Past performance is no

guarantee of future results.

Start here:

-

Learn how to

use the Strategic Plan

-

Review our current

strategic plan

-

How the Strategic Plan works with the Investment Rate

-

A Test to verify that you understand the Strategic Plan

-

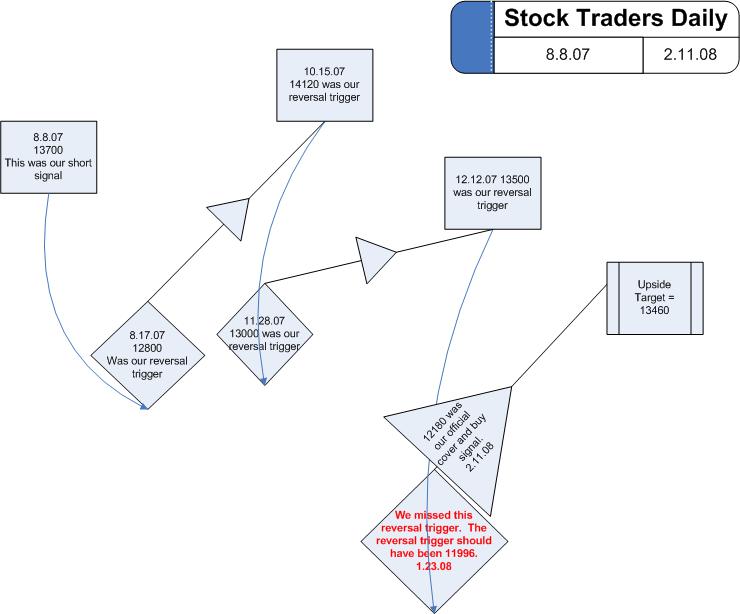

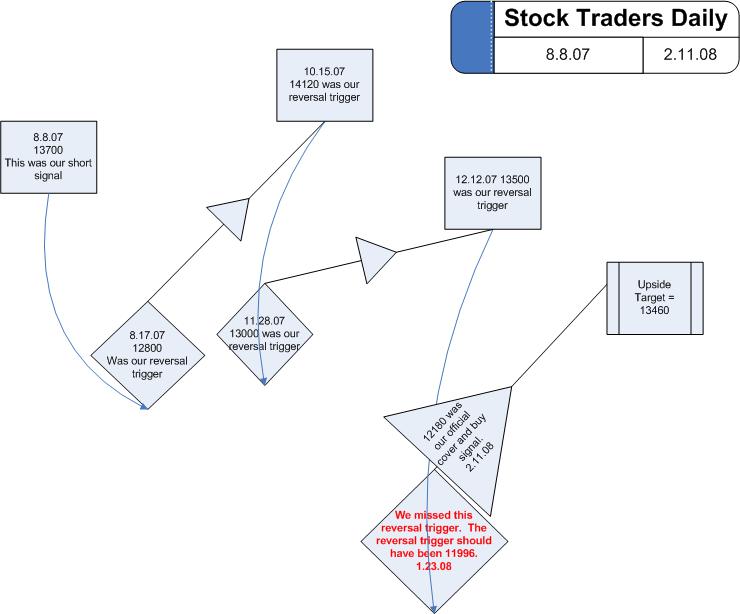

Review the performance of the plan since 8.07

How to use the Strategic plan:

The Strategic Plan is

intended to be used in conjunction with our longer term

analysis. We use the Dow Jones Industrial Average for

Market Timing signals. With integrated risk controls,

our Strategic Plan is a proactive alternative to buy and

hold investments.

The strategy involves two

correlated ETFs. We use DDM and DXD to take advantage

of defined market cycles.

-

DDM is the double

weighted long Proshare representing the Dow Jones

Industrial Average.

-

DXD is the double

weighted short Proshare representing the Dow Jones

Industrial Average.

Our approach is refined to

simplify the process. When short signals surface, we

buy DXD. When long signals surface, we buy DDM.

We do not trade any other instruments, and we never actually

short anything. However, DXD is a built - in short, so

we do take advantage of downward market moves when they

occur. With that, the Strategic Plan can also be used

in IRAs.

There are two occasions in

which short signals present themselves, and two for long

signals as well:

-

We buy only when support

is tested, or when resistance breaks higher. (buy DDM)

-

We short only when

resistance is tested or when support breaks lower.

(buy DXD)

Entry levels are

restricted. The Dow must be within 25 points of a

respective support or resistance level in order to trigger a

new trade. A wider spread offsets our risk controls,

and makes them ineffective.

Risk Controls are integral.

We use 0.5% stop losses in these positions. If our

entry level is within 25 points of the stated parameter, the

0.5% stop should only trigger when that respective

parameter is breached. The 0.5% stop was chosen

because it correlates with our entry level

restriction of 25 points. They are

interrelated, and should be used together.

Conversion Strategies

are important to this model. For example, assume

support is tested and we buy DDM because the Market

is within 25 points of support. According to

rule, we would set a 0.5% stop loss in DDM.

If support breaks and that DDM position is stopped out with a 0.5% loss,

we revert immediately back to the rules.

Specifically, the 25 point rule should be observed.

If the Market is now under support but still within

25 points, we will buy DXD, set a 0.5% stop loss,

and observe the same set of rules. All we have

done is convert from long to short. We may

convert back and forth a number of times before

securing gains. In certain situations, we may

be stopped, and could re-enter the same position

because the rules tell us to. Therefore,

conversion is not automatic, but instead based on

the rules.

Exit Strategies are

based on one of two criteria. Either the targeted

support or resistance level must be officially tested, or

the gains from the ETF we have entered must be greater than

or equal to 10%.

-

Tests of support or

resistance require the market to be within 25 points of

support or resistance.

-

10% profits are based on

a reversal strategy. That means, we want to set a

profit stop to secure 10% in profits when we are holding

slightly more than 10%, and then let the position follow

through to the next support or resistance level

accordingly. However, if at any time the Market

reverses against us and the profit stop is triggered we

should willing accept the 10% lock in, and wait for the

next trading signal.

Early Exits occur when

we lock in gains before the targeted support or resistance

level is tested. This would only occur when we secure

10% in gains. However, this also requires an added

degree of patience. New trades are based on tests of

support or resistance, so if we lock in gains early new

trades may not happen for a while. New trades must not

be made in the middle of a channel. If that rule can

be respected, early exits can be rewarding because re-tests

of parameters occur regularly.

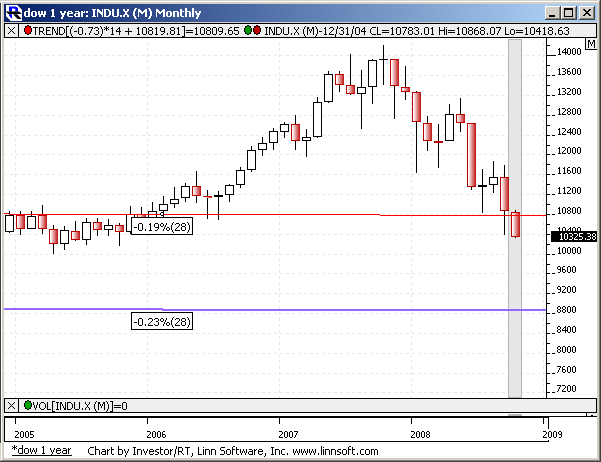

Trading Parameters are

focused on the Dow Jones Industrial Average, and they can be

found either by reviewing the longer term chart of the Dow,

or by reviewing our Strategic Plan page on a regular basis.

These are almost always part of our nightly emails as well.

The above rules should be

used in conjunction with our ongoing Strategic Plan

Our

Current Strategic Plan

After another stop, we ended in DDM again:

|

6/8/2010 |

DDM |

39.62 |

39.42 |

6/9/2010 |

-0.2 |

-0.50% |

|

6/9/2010 |

DXD |

30.56 |

30.4 |

6/9/2010 |

-0.16 |

-0.52% |

|

6/9/2010 |

DDM |

39.66 |

|

|

|

|

Updated 6.10.10

Set

a profit stop in DDM if the Market moves higher.

Specifically, if DDM hits $43.5, set a profit stop

at $43.25 and let it ride. Additional

instruction will be provided when it is required.

Updated 6.8.10:

We

converted to DDM.

|

6/7/2010 |

DXD |

30.62 |

30.46 |

6/8/2010 |

-0.16 |

-0.52% |

|

$40,337 |

DDM |

39.62 |

|

|

|

|

Updated 6.7.10:

We

ended the day in DXD. We were stopped a number

of times. This phase of the Strategic Plan has

turned out to be tough. More than anything

else, we were on the verge of securing gains just

two days ago, that is the toughest part.

However, we have now transitioned lower, and if the

Market declines we will make money again. This

has already happened once this year. I mean,

we have already had a challenging phase. That

was the second phase of the year. Even with

that, we are up nicely this year already. I

believe we will experience a similar result as that

last challenging phase. It requires a resolve,

and adherence to discipline.

|

6/7/2010 |

DDM |

39.84 |

39.64 |

6/7/2010 |

-0.2 |

-0.50% |

|

6/7/2010 |

DDM |

39.67 |

39.46 |

6/7/2010 |

-0.21 |

-0.53% |

|

6/7/2010 |

DXD |

30.6 |

30.44 |

6/7/2010 |

-0.16 |

-0.52% |

|

6/7/2010 |

DDM |

39.68 |

39.46 |

6/7/2010 |

-0.22 |

-0.55% |

|

6/7/2010 |

DXD |

30.64 |

30.46 |

6/7/2010 |

-0.18 |

-0.59% |

|

6/7/2010 |

DDM |

39.68 |

39.46 |

6/7/2010 |

-0.22 |

-0.55% |

|

6/7/2010 |

DXD |

30.62 |

|

|

|

|

Updated 6.6.10:

We

ended in cash. I do not see how anyone could

have re-entered DDM after the DXD stop. There

was less than 2 seconds left in the trading day

after the stop occurred. The stop should have

been executed, but re-entering DDM was impossible.

When the 25 point rule is satisfied again we will

take action according to rule.

|

5/25/2010 |

DDM |

39.86 |

39.65 |

6/4/2010 |

-0.21 |

-0.53% |

|

6/4/2010 |

DXD |

30.4 |

30.24 |

6/4/2010 |

-0.16 |

-0.53% |

|

6/4/2010 |

DDM |

39.82 |

39.62 |

6/4/2010 |

-0.2 |

-0.50% |

|

6/4/2010 |

DXD |

30.43 |

30.27 |

6/4/2010 |

-0.16 |

-0.53% |

Updated 5.27.10:

Set

a profit stop in DDM if the Market moves higher.

Specifically, if DDM hits $43.8, set a profit stop

at $43.51 and let it ride. Additional

instruction will be provided when it is required.

Updated 5.25.10:

After a few stops, we ended the day in DDM again:

|

5/21/2010 |

DDM |

39.86 |

39.2 |

5/25/2010 |

-0.66 |

-1.66% |

|

5/25/2010 |

DXD |

30.92 |

30.76 |

5/25/2010 |

-0.16 |

-0.52% |

|

5/25/2010 |

DXD |

30.77 |

30.61 |

5/25/2010 |

-0.16 |

-0.52% |

|

5/25/2010 |

DDM |

39.86 |

|

|

|

|

Updated 5.23.10

We

entered DDM on Friday when the Market tested 9904.

If

DDM gets to 43.8 set a profit stop at 43.7 and let

it ride.

Updated 5.20.10:

We

secured 9.52% from DXD. We are now in cash and

waiting for a new trading signals according to the

rules. Review the Strategic Plan Parameters

above and the Rules associated with them for

entries.

|

5/18/2010 |

DXD |

26.47 |

28.99 |

5/20/2010 |

2.52 |

9.52% |

$181,616 |

Updated 5.20.10:

If DXD gets to 29.1 set a profit stop at 28.99 and

let it ride.

This will secure 10% and give us the opportunity for

more if the Market continues to decline.

Updated 5.18.10:

We

stopped DXD and re-entered it. This is a

REVERSION strategy, not a conversion strategy.

If we are stopped, we revert to the rules.

That means, we respect the 25 point rule. This

time, we were stopped, but the Market was still

below 10725. As a result, we immediately

re-entered DXD. This is NOT a conversions

strategy, but instead it is a REVERSION streategy.

|

5/14/2010 |

DXD |

26.6 |

26.46 |

5/18/2010 |

-0.14 |

-0.53% |

|

5/18/2010 |

DXD |

26.47 |

|

|

|

|

Updated 5.14.10:

DDM

was stopped and we converted to DXD.

|

5/10/2010 |

DDM |

46.58 |

46.34 |

5/14/2010 |

-0.24 |

-0.52% |

|

5/14/2010 |

DXD |

26.6 |

|

|

|

|

Updated 5.12.10:

If

DDM hits $51.2 set a profit stop at $50.99 and let

it ride.

Updated 5.9.10:

After a series of stops, we ended in DDM:

|

5/10/2010 |

DDM |

46.87 |

46.62 |

5/10/2010 |

-0.25 |

-0.53% |

|

5/10/2010 |

DDM |

46.63 |

46.39 |

5/10/2010 |

-0.24 |

-0.51% |

|

5/10/2010 |

dxd |

26.65 |

26.51 |

5/10/2010 |

-0.14 |

-0.53% |

|

5/10/2010 |

ddm |

46.61 |

46.37 |

5/10/2010 |

-0.24 |

-0.51% |

|

5/10/2010 |

dxd |

26.67 |

26.53 |

5/10/2010 |

-0.14 |

-0.52% |

|

5/10/2010 |

ddm |

46.59 |

46.35 |

5/10/2010 |

-0.24 |

-0.52% |

|

5/10/2010 |

dxd |

26.7 |

26.56 |

5/10/2010 |

-0.14 |

-0.52% |

|

5/10/2010 |

ddm |

46.56 |

46.32 |

5/10/2010 |

-0.24 |

-0.52% |

|

5/10/2010 |

dxd |

26.68 |

26.53 |

5/10/2010 |

-0.15 |

-0.56% |

|

5/10/2010 |

ddm |

46.58 |

|

|

|

|

Updated 5.6.10:

There were two trades today, resulting in gains of

over 9%. We started by buying DDM near 10725,

we converted to DXD when it stopped, and we should

have also entered DDM near 9904, but that position

was impossible to fill. In fact, the fill

recorded for DXD is far off the level at which it

should have been filled, because the fast market

caused some of you to get very bad fills, and some

of you got executions like this, instead of over

$30. Still, the returns were good.

We

should be in cash, waiting for another trigger.

Soon, the Strategic Plan parameters may change, but

they remain as they are for now: 6485 - 9083 - 9904 - 10725 - 11724

|

5/6/2010 |

DDM |

46.85 |

46.6 |

5/6/2010 |

-0.25 |

-0.53% |

$153,610 |

|

5/6/2010 |

DXD |

26.78 |

29.45 |

5/6/2010 |

2.67 |

9.97% |

$163,580 |

Updated 4.27.10:

DDM

was closed near $50.66. We secured

approximately 8% and we are now in cash. We

should be waiting for the next test of either

support or resistance to occur before we take

action. Use the rules and the associated

parameters to identify trading signals.

Updated 4.26.10:

Sell DDM at market tomorrow after the Market opens.

DDM

hit $51.32 on Monday. The Market is very close

to turning lower according to our analysis, and it

could happen without the Dow testing longer term

resistance. This is because the Dow has been

lagging behind the other Markets. Therefore,

the profit stop plan needs to be adjusted.

Instead of waiting for $51.45 exactly, we should be

willing to sell now, just in case the Market turns

down without the test of longer term resistance that

would normally occur in the Dow too.

Our

revised plan is to sell @ Market on Tuesday morning,

move to cash, and revert to the rules. The

parameters for the Strategic Plan are not changing.

Expect an exact price to be shown tomorrow, in

tomorrow's update.

Updated 4.14.10:

If

DDM gets to $51.45 set a profit stop at $51.35 and

let it ride.

Updated 3.22.10:

We

converted into DDM:

|

3/19/2010 |

DXD |

27.14 |

27 |

3/22/2010 |

-0.14 |

-0.52% |

|

3/22/2010 |

DDM |

46.79 |

|

|

|

|

Updated 3.19.10:

We

converted into DXD:

|

3/18/2010 |

DDM |

46.8 |

46.56 |

3/19/2010 |

-0.24 |

-0.51% |

|

3/19/2010 |

DXD |

27.15 |

27.01 |

3/19/2010 |

-0.14 |

-0.52% |

|

3/19/2010 |

DDM |

46.81 |

46.56 |

3/19/2010 |

-0.25 |

-0.53% |

|

3/19/2010 |

DXD |

27.14 |

|

|

|

|

Updated 3.18.10:

We

transitioned to DDM

|

3/17/2010 |

DXD |

27.17 |

27.01 |

3/18/2010 |

-0.16 |

-0.59% |

|

3/18/2010 |

DDM |

46.8 |

|

|

|

|

Updated 3.17.10

We

ended the day long DXD. Here are the series of

trades:

|

3/17/2010 |

DXD |

27.17 |

27.03 |

3/17/2010 |

-0.14 |

-0.52% |

|

3/17/2010 |

DDM |

46.79 |

46.55 |

3/17/2010 |

-0.24 |

-0.51% |

|

3/17/2010 |

DXD |

27.17 |

|

|

|

|

Updated 3.16.10:

DDM

was sold for a net gain of 9.34%. We are now

in cash and waiting for a new trading signal based

on the established rules and related parameters.

|

2/16/2010 |

DDM |

42.06 |

45.99 |

3/16/2010 |

3.93 |

9.34% |

$149,568 |

Updated 3.1.10:

The

parameters for the strategic plan have been updated,

and profit stop rules for the current DDM position

have been offered in this update.

The

new parameters for the Strategic Plan are:

6485 - 9083 - 9904 - 10725 - 11724

We

are currently holding DDM. If you are not, and

you want to participate in the next phase of the

Strategic Plan, expect to do so at 10725. Use

the rules outlined above to guide your trades.

However, if you are holding DDM already, instead of

initiating new trades around 10725, start by setting

a profit stop in DDM if it breaks above $46 instead.

Specifically, if DDM breaks above $46.1 set a profit

stop at $45.99 and let it ride from there.

Only if it stops, convert to the rules outlined

above for new trades.

Updated 2.16.10.

We

were stopped out of DXD, but the Market was still

under 10200 when that happened. That caused a

re-trigger according to rule. However, that

stopped as well, and we transitioned to DDM.

We should be holding DDM as follows, with

the risk controls outlined above in place:

|

2/4/2010 |

DXD |

30.55 |

30.38 |

2/16/2010 |

-0.17 |

|

2/16/2010 |

DXD |

30.4 |

30.24 |

2/16/2010 |

-0.16 |

|

2/16/2010 |

DDM |

42.06 |

|

|

|

Updated 2.4.10:

This phase of the Strategic Plan has been rough.

At least, it has thus far. The trades are

listed below.

We

are currently holding DXD with about 3.5% in paper

gains. Because the Market is capable of

declining aggressively, we need to develop an exit

plan now. This is based on our 10% lock rule.

This is what we will do:

If

DXD gets to $33.55 we will place a profit stop at

$33.4 and let that ride. If it stops, we will

secure gains and move to cash. If the stock

moves higher, we will adjust the profit stop higher

according to updates offered in the nightly

newsletter and on this page.

If

the Market reverses higher before we secure gains,

we will convert higher again by rule.

Here are the trades from this phase thus far:

|

1/19/2010 |

DXD |

27.74 |

30.5 |

1/22/2010 |

2.76 |

9.95% |

$150,215 |

|

1/22/2010 |

DDM |

42.04 |

41.8 |

1/22/2010 |

-0.24 |

-0.57% |

$149,645 |

|

1/22/2010 |

DXD |

30.66 |

30.28 |

1/25/2010 |

-0.38 |

-1.24% |

$148,405 |

|

1/25/2010 |

DDM |

42.16 |

41.94 |

1/25/2010 |

-0.22 |

-0.52% |

$147,883 |

|

1/25/2010 |

DXD |

30.57 |

30.41 |

1/25/2010 |

-0.16 |

-0.52% |

$147,360 |

|

1/25/2010 |

DDM |

42.15 |

41.94 |

1/25/2010 |

-0.21 |

-0.50% |

$146,862 |

|

1/25/2010 |

DXD |

30.55 |

30.39 |

1/26/2010 |

-0.16 |

-0.52% |

$146,338 |

|

1/26/2010 |

DDM |

42.17 |

41.92 |

1/26/2010 |

-0.25 |

-0.59% |

$145,745 |

|

1/26/2010 |

DXD |

30.56 |

30.4 |

1/27/2010 |

-0.16 |

-0.52% |

$145,222 |

|

1/27/2010 |

DDM |

42.16 |

41.91 |

1/28/2010 |

-0.25 |

-0.59% |

$144,629 |

|

1/27/2010 |

DXD |

30.55 |

30.38 |

1/27/2010 |

-0.17 |

-0.56% |

$144,072 |

|

1/27/2010 |

DDM |

42.18 |

41.94 |

1/28/2010 |

-0.24 |

-0.57% |

$143,503 |

|

1/28/2010 |

DXD |

30.56 |

30.39 |

1/28/2010 |

-0.17 |

-0.56% |

$142,947 |

|

1/28/2010 |

DDM |

42.15 |

41.9 |

1/28/2010 |

-0.25 |

-0.59% |

$142,354 |

|

1/28/2010 |

DXD |

30.54 |

30.38 |

2/1/2010 |

-0.16 |

-0.52% |

$141,830 |

|

2/1/2010 |

DDM |

42.1 |

41.88 |

2/4/2010 |

-0.22 |

-0.52% |

$141,307 |

|

2/4/2010 |

DXD |

30.55 |

|

|

|

|

|

Updated 1.28.10:

We

ended the session holding DXD:

|

1/27/2010 |

DDM |

42.16 |

41.91 |

1/28/2010 |

-0.25 |

-0.59% |

|

1/28/2010 |

DXD |

30.55 |

|

|

|

|

Updated 1.27.10:

We

held a webinar today discussing the Strategic Plan.

The notion is, if we can remove the stupid human

restrictions we impose on ourselves, this strategy

can work for us over time. It is simple, and

maybe too simple. We will have more losses

than gains, but the gains outweigh the losses, and

over time we have excelled. This is a Tortoise

vs Hare Strategy. It has shattered Market

performance in the past. It works, but it

requires users to follow the strategy appropriately,

not selectively.

|

1/26/2010 |

DXD |

30.56 |

30.4 |

1/27/2010 |

-0.16 |

-0.52% |

|

1/27/2010 |

DDM |

42.16 |

|

|

|

|

We

are holding DDM with strict risk controls in place.

Updated 1.26.10:

We

had a couple stops. We were holding nice

intraday gains in DDM, but the late day reversal on

Tuesday stopped us out of DDM, and we ended the day

holding DXD again.

|

1/25/2010 |

DXD |

30.55 |

30.39 |

1/26/2010 |

-0.16 |

-0.52% |

|

1/26/2010 |

DDM |

42.17 |

41.92 |

1/26/2010 |

-0.25 |

-0.59% |

|

1/26/2010 |

DXD |

30.56 |

|

|

|

|

Updated 1.25.10:

We

were stopped a few times, the first time for a

larger than expected loss. We ended the

session holding DXD with strict risk controls in

place.

|

1/22/2010 |

DXD |

30.66 |

30.28 |

1/25/2010 |

-0.38 |

-1.24% |

|

1/25/2010 |

DDM |

42.16 |

41.94 |

1/25/2010 |

-0.22 |

-0.52% |

|

1/25/2010 |

DXD |

30.57 |

30.41 |

1/25/2010 |

-0.16 |

-0.52% |

|

1/25/2010 |

DDM |

42.15 |

41.94 |

1/25/2010 |

-0.21 |

-0.50% |

|

1/25/2010 |

DXD |

30.55 |

|

|

|

|

Updated 1.24.10:

We

secured 9.95% in DXD, then attempted to buy the test

of 10200. That failed, 10200 broke, and we

converted back to DXD according to rule. We

are currently holding DXD with strict risk controls

in place.

|

DXD |

30.54 |

30.38 |

9-Dec |

-0.16 |

-0.52% |

$131,728 |

|

DDM |

42.75 |

46.4 |

1/19/2010 |

3.65 |

8.54% |

$140,266 |

|

DXD |

27.74 |

30.5 |

1/22/2010 |

2.76 |

9.95% |

$150,215 |

|

DDM |

42.04 |

41.8 |

1/22/2010 |

-0.24 |

-0.57% |

$149,645 |

|

DXD |

30.66 |

|

|

|

|

|

The

Dow Parameters for the Strategic Plan are:

5300 - 6485 - 9083 - 10200 - 10750 - 11724

Updated 1.21.09:

We are holding DXD

from 10750 (entry was near $27.74).

10200 is our

support inflection parameter. If 10200 is

tested, take profits in DXD. I estimate, we

will secure gains at about $30.50 if 10200 is

tested. That will be very close to our usual

10% goal for securing gains in the Strategic

Plan. We will not use profit stops this time.

Instead, if/when 10200 is tested, we will take

profits, and then we will start the next phase.

Ahead of the

Curve:

In addition, if

you are late, and getting excited about trading

this market, realize something. You cannot

trade effectively behind the curve. If you try,

you will not be able to use risk controls

effectively. Being ahead of the curve is

important. The Market has already fallen hard

from our entry. New entries here are

effectively behind the curve.

Updated 1.19.10

10750 was tested, we secured 8.54% in gains, we

closed DDM, and we are now in DXD according to rule.

|

11/2/2009 |

DXD |

34.87 |

34.69 |

2-Nov |

-0.18 |

-0.52% |

$139,122 |

|

11/11/2009 |

DXD |

30.72 |

30.56 |

12-Nov |

-0.16 |

-0.52% |

$138,602 |

|

11/11/2009 |

DDM |

42.77 |

42.55 |

11-Nov |

-0.22 |

-0.51% |

$138,087 |

|

11/11/2009 |

DXD |

30.67 |

30.51 |

11-Nov |

-0.16 |

-0.52% |

$137,566 |

|

11/12/2009 |

DXD |

30.71 |

30.46 |

19-Nov |

-0.25 |

-0.81% |

$136,752 |

|

11/12/2009 |

DDM |

42.72 |

42.5 |

12-Nov |

-0.22 |

-0.51% |

$136,237 |

|

11/12/2009 |

DXD |

30.71 |

30.55 |

12-Nov |

-0.16 |

-0.52% |

$135,716 |

|

11/12/2009 |

DDM |

42.73 |

42.51 |

12-Nov |

-0.22 |

-0.51% |

$135,201 |

|

11/19/2009 |

DDM |

42.66 |

42.32 |

27-Nov |

-0.34 |

-0.80% |

$134,404 |

|

11/19/2009 |

DXD |

30.73 |

30.56 |

19-Nov |

-0.17 |

-0.55% |

$133,850 |

|

11/19/2009 |

DDM |

42.72 |

42.5 |

19-Nov |

-0.22 |

-0.51% |

$133,335 |

|

11/27/2009 |

DDM |

42.64 |

42.4 |

9-Dec |

-0.24 |

-0.56% |

$132,773 |

|

11/27/2009 |

DXD |

30.72 |

30.56 |

27-Nov |

-0.16 |

-0.52% |

$132,252 |

|

12/9/2009 |

DXD |

30.54 |

30.38 |

9-Dec |

-0.16 |

-0.52% |

$131,728 |

|

12/9/2009 |

DDM |

42.75 |

46.4 |

1/19/2010 |

3.65 |

8.54% |

$140,266 |

|

1/19/2010 |

DXD |

27.74 |

|

|

|

|

|

Updated 12.7.09:

The

Strategic Plan parameters have changed. Find

them below.

If

10750 is tested, we should sell DDM.

5300 - 6485 - 9083 - 10290 - 10750 - 11724

Updated 12.2.09:

We

should be long DDM:

|

YTD Return: |

Strategic |

Plan = |

39.12% |

|

|

|

|

|

|

|

|

Enter date |

ETF |

Enter price |

Exit price |

Exit Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

27-Nov |

DDM |

42.64 |

|

|

|

27-Nov |

DXD |

30.72 |

30.56 |

27-Nov |

|

19-Nov |

DDM |

42.66 |

42.32 |

27-Nov |

|

19-Nov |

DXD |

30.73 |

30.56 |

19-Nov |

|

19-Nov |

DDM |

42.72 |

42.5 |

19-Nov |

|

12-Nov |

DXD |

30.71 |

30.46 |

19-Nov |

|

12-Nov |

DDM |

42.72 |

42.5 |

12-Nov |

|

12-Nov |

DXD |

30.71 |

30.55 |

12-Nov |

|

12-Nov |

DDM |

42.73 |

42.51 |

12-Nov |

|

11-Nov |

DXD |

30.72 |

30.56 |

12-Nov |

|

11-Nov |

DDM |

42.77 |

42.55 |

11-Nov |

|

11-Nov |

DXD |

30.67 |

30.51 |

11-Nov |

Updated 11.22.09:

We

should be long DDM:

|

YTD Return: |

Strategic |

Plan = |

39.12% |

|

|

|

|

|

|

|

|

Enter date |

ETF |

Enter price |

Exit price |

Exit Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

19-Nov |

DDM |

42.66 |

|

|

|

19-Nov |

DXD |

30.73 |

30.56 |

|

|

19-Nov |

DDM |

42.72 |

42.5 |

|

|

12-Nov |

DXD |

30.71 |

30.46 |

|

|

12-Nov |

DDM |

42.72 |

42.5 |

|

|

12-Nov |

DXD |

30.71 |

30.55 |

|

|

12-Nov |

DDM |

42.73 |

42.51 |

|

|

11-Nov |

DXD |

30.72 |

30.56 |

|

|

11-Nov |

DDM |

42.77 |

42.55 |

|

|

11-Nov |

DXD |

30.67 |

30.51 |

|

Updated 11.16.09:

DXD

stopped, but we did not have enough time to enter

DDM. We should be in cash and ready to trigger

again upon the next test of support or resistance.

|

12-Nov |

DXD |

30.71 |

30.46 |

|

12-Nov |

DDM |

42.72 |

42.5 |

|

12-Nov |

DXD |

30.71 |

30.55 |

|

12-Nov |

DDM |

42.73 |

42.51 |

|

11-Nov |

DXD |

30.72 |

30.56 |

|

11-Nov |

DDM |

42.77 |

42.55 |

|

11-Nov |

DXD |

30.67 |

30.51 |

Updated 11.12.09:

We

should be holding DXD:

|

12-Nov |

DXD |

30.71 |

|

|

|

|

|

12-Nov |

DDM |

42.72 |

42.5 |

|

|

|

|

12-Nov |

DXD |

30.71 |

30.55 |

|

|

|

|

12-Nov |

DDM |

42.73 |

42.51 |

|

|

|

|

11-Nov |

DXD |

30.72 |

30.56 |

|

|

|

|

11-Nov |

DDM |

42.77 |

42.55 |

|

|

|

|

11-Nov |

DXD |

30.67 |

30.51 |

|

|

|

Updated 11.11.09:

We

should currently be holding DXD.

5300 - 6524 - 8051 -

9683 - 10290 - 10745

If

10290 holds, expect 9683. Otherwise, if 10290

breaks higher and we convert, expect 10745 instead.

|

YTD Return: |

Strategic |

Plan = |

39.12% |

|

|

|

|

|

|

|

|

|

|

|

|

Enter date |

ETF |

Enter price |

Exit price |

Exit Date |

Difference |

% return |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11-Nov |

DXD |

30.72 |

|

|

|

|

|

11-Nov |

DDM |

42.77 |

42.55 |

|

|

|

|

11-Nov |

DXD |

30.67 |

30.51 |

|

|

|

Updated 11.11.09:

After the last series of stops, I expected this

phase of the Strategic plan to have been a losing

one. However, we came out with only a few

bruises. We made less than 1% in the last

phase. We locked in 12% in gains, but we were

carrying losses that offset the gains. Those

losses increased quite a bit in recent days, when

the Market fell back to 9728. That was not a

good inflection parameter at the time, so I changed

it, and saved us another round of stops. If

more stops happened, this may just have been a

losing phase.

In

any respect, to the most recent phase, I am glad to

see you go.

With that said, if this is as hard as it gets, it

really isn't that bad is it? If you are

comparing the results to the Market, you should not

be doing that. The results of one phase does

not define this strategy. If you choose to

compare market returns, use 2008, and the complete

year 2009. Clearly, the Strategic Plan is far

ahead of the Market. The Strategic Plan is

completely unrelated to market returns. It

works when the Market falls too. That is why

it is appropriate.

I

do not consider this a bad phase of the Strategic

Plan, but it did take more patience than we have

been used to this year. It actually worked

well on the basis of wealth preservation, with

opportunities coming second. Still, over time,

the result have been there.

Here are all the trades from the last round:

|

YTD Return: |

Strategic |

Plan = |

39.12% |

|

|

|

|

|

|

|

|

|

|

|

|

Enter date |

ETF |

Enter price |

Exit price |

Exit Date |

Difference |

% return |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2-Nov |

DDM |

37.81 |

42.6 |

11-Nov |

4.79 |

12.67% |

|

2-Nov |

DXD |

34.87 |

34.69 |

2-Nov |

-0.18 |

-0.52% |

|

30-Oct |

DDM |

38.06 |

37.64 |

2-Nov |

-0.42 |

-1.10% |

|

30-Oct |

DXD |

34.66 |

34.48 |

30-Oct |

-0.18 |

-0.52% |

|

30-Oct |

DDM |

38.06 |

37.81 |

30-Oct |

-0.25 |

-0.66% |

|

30-Oct |

DXD |

34.69 |

34.51 |

30-Oct |

-0.18 |

-0.52% |

|

30-Oct |

DDM |

38.05 |

37.82 |

30-Oct |

-0.23 |

-0.60% |

|

8-Oct |

DDM |

38.25 |

38.06 |

30-Oct |

-0.19 |

-0.50% |

|

7-Oct |

DXD |

34.87 |

34.43 |

8-Oct |

-0.44 |

-1.26% |

|

7-Oct |

DXD |

35.05 |

34.85 |

7-Oct |

-0.2 |

-0.57% |

|

6-Oct |

DDM |

38.03 |

37.81 |

7-Oct |

-0.22 |

-0.58% |

|

6-Oct |

DXD |

35.05 |

34.87 |

6-Oct |

-0.18 |

-0.51% |

|

6-Oct |

DDM |

38.02 |

37.82 |

6-Oct |

-0.2 |

-0.53% |

|

30-Sep |

DXD |

35.07 |

34.89 |

6-Oct |

-0.18 |

-0.51% |

|

30-Sep |

DDM |

38.16 |

37.95 |

30-Sep |

-0.21 |

-0.55% |

|

30-Sep |

DXD |

34.87 |

34.67 |

30-Sep |

-0.2 |

-0.57% |

|

28-Sep |

DDM |

38.16 |

37.96 |

30-Sep |

-0.2 |

-0.52% |

|

24-Sep |

DXD |

35.08 |

34.9 |

28-Sep |

-0.18 |

-0.51% |

|

16-Sep |

DDM |

38.23 |

38.03 |

24-Sep |

-0.2 |

-0.52% |

|

15-Sep |

DXD |

35.26 |

35.08 |

16-Sep |

-0.18 |

-0.51% |

Updated 11.09.09:

We

are currently holding approximately 11% in gains

from our November 2nd entry.

Set

a profit stop at $41.5. If it hits, sell DDM

and revert back to the rules. Otherwise, sell

at 10290. 10290 is the next inflection point.

If it is tested sell DDM, secure gains, and revert

to the rules.

The

only derivation to this would come if the Market

opens above 10290 on Tuesday. That does not

appear likely to happen, but if it does 10290 would

be our profit stop threshold. IE, we would

hold DDM unless it breaks. More will be said

on this subject if the Market seems to be starting

with a gap higher Tuesday.

Here

is the data array:

5300 - 6524 - 8051 -

9683 - 10290 - 10745

Updated 11.4.09:

In

the last few days we have been stopped a few times

in a row. I adjusted the parameters so that

9683 is now the trigger point. That reduced

our entries a little bit. My effort is to put

a halt to the choppiness around 9728. There

was a number of stops on October 30th. This

adjustment should reconcile that.

I

also realize we were holding approximately 7.5% in

gains when i issued my Top of the Market report on

October 22nd. However, we never reached the

10% threshold. The result was a stop.

Here are the trades:

|

YTD Return: |

Strategic |

Plan = |

38.03% |

|

|

|

|

|

|

|

0 |

|

|

|

|

Enter date |

ETF |

Enter price |

Exit price |

Exit Date |

Difference |

% return |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2-Nov |

DDM |

37.81 |

|

|

|

|

|

2-Nov |

DXD |

34.87 |

34.69 |

2-Nov |

|

|

|

30-Oct |

DDM |

38.06 |

37.64 |

2-Nov |

|

|

|

30-Oct |

DXD |

34.66 |

34.48 |

30-Oct |

|

|

|

30-Oct |

DDM |

38.06 |

37.81 |

30-Oct |

|

|

|

30-Oct |

DXD |

34.69 |

34.51 |

30-Oct |

|

|

|

30-Oct |

DDM |

38.05 |

37.82 |

30-Oct |

|

|

|

8-Oct |

DDM |

38.25 |

38.06 |

30-Oct |

|

|

|

7-Oct |

DXD |

34.87 |

34.43 |

8-Oct |

|

|

|

7-Oct |

DXD |

35.05 |

34.85 |

7-Oct |

|

|

|

6-Oct |

DDM |

38.03 |

37.81 |

7-Oct |

|

|

|

6-Oct |

DXD |

35.05 |

34.87 |

6-Oct |

|

|

|

6-Oct |

DDM |

38.02 |

37.82 |

6-Oct |

|

|

|

30-Sep |

DXD |

35.07 |

34.89 |

6-Oct |

|

|

|

30-Sep |

DDM |

38.16 |

37.95 |

30-Sep |

|

|

|

30-Sep |

DXD |

34.87 |

34.67 |

30-Sep |

|

|

|

28-Sep |

DDM |

38.16 |

37.96 |

30-Sep |

|

|

|

24-Sep |

DXD |

35.08 |

34.9 |

28-Sep |

|

|

|

16-Sep |

DDM |

38.23 |

38.03 |

24-Sep |

|

|

|

15-Sep |

DXD |

35.26 |

35.08 |

16-Sep |

|

|

Updated 10.31.09:

We

were close to a 'lock' in the Strategic Plan, but

the sudden reversal in the Market has caused us to

be stopped again around 9728. Although the

Market seemed to respect it as a longer term

inflection parameter before, and we almost secured

10%. we must reconsider it as an inflection

parameter. After doing so, I concluded that a

slightly lower level is more appropriate as

inflection at this time. I have revised the

parameters down accordingly. Find the revised

parameters below.

This is how we will handle 9728: We should

have DDM. This was based on 9728. Because we

lowered it to 9683, we need to widen the stop on

this position slightly. Because of this

change, lower the stop on DDM to execute if the Dow

hits 9680. If it does, stop DDM and revert

back to the rules. If it does not get there,

expect aggressively higher levels over time.

If

you were smart enough to close out the last position

when I issued my Top of the Market report on

10.22.09, you should use 9683 as inflection, and a

trigger point for the Strategic Plan.

Dow parameters for Strategic Plan:

5300 - 6524 - 8051 -

9683 - 10290 - 10745

Updated 10.22.09:

The top of the Market is near:

http://stocktradersdaily.com/top2/top2/top2.htm

Updated 10.19.09:

Three possible scenarios:

-

If DDM gets to

$42.07 set a profit stop at $41.99 and let it

ride.

-

If DDM breaks

above $42.07 and the Market tests 10400 without

DDM stopping, sell DDM when 10400 is tested and

revert to the rules.

-

If the market

breaks down instead, stop DDM according to stop

loss rule that is in place now.

Updated 10.8.09

We

experienced a larger than usual stop, and then

re-entered DDM.

We

should be holding DDM.

|

8-Oct |

DDM |

38.25 |

|

|

|

7-Oct |

DXD |

34.87 |

34.43 |

8-Oct |

|

7-Oct |

DXD |

35.05 |

34.85 |

7-Oct |

|

6-Oct |

DDM |

38.03 |

37.81 |

7-Oct |

|

6-Oct |

DXD |

35.05 |

34.87 |

6-Oct |

|

6-Oct |

DDM |

38.02 |

37.82 |

6-Oct |

|

30-Sep |

DXD |

35.07 |

34.89 |

6-Oct |

|

30-Sep |

DDM |

38.16 |

37.95 |

30-Sep |

|

30-Sep |

DXD |

34.87 |

34.67 |

30-Sep |

|

28-Sep |

DDM |

38.16 |

37.96 |

30-Sep |

|

24-Sep |

DXD |

35.08 |

34.9 |

28-Sep |

|

16-Sep |

DDM |

38.23 |

38.03 |

24-Sep |

|

15-Sep |

DXD |

35.26 |

35.08 |

16-Sep |

Updated 10.7.09:

A

couple more stops occurred on Wednesday. This

was unusual though. At 10:18 AM Et a stop

occurred when we were in DXD, but the Market was

still under 9728. That meant we had to

re-enter DXD again according to rule, and not

convert to DDM. That is why there are two DXD

trades in a row.

We

should be holding DXD.

|

7-Oct |

DXD |

34.87 |

|

|

|

7-Oct |

DXD |

35.05 |

34.85 |

7-Oct |

|

6-Oct |

DDM |

38.03 |

37.81 |

7-Oct |

|

6-Oct |

DXD |

35.05 |

34.87 |

6-Oct |

|

6-Oct |

DDM |

38.02 |

37.82 |

6-Oct |

|

30-Sep |

DXD |

35.07 |

34.89 |

6-Oct |

|

30-Sep |

DDM |

38.16 |

37.95 |

30-Sep |

|

30-Sep |

DXD |

34.87 |

34.67 |

30-Sep |

|

28-Sep |

DDM |

38.16 |

37.96 |

30-Sep |

|

24-Sep |

DXD |

35.08 |

34.9 |

28-Sep |

|

16-Sep |

DDM |

38.23 |

38.03 |

24-Sep |

|

15-Sep |

DXD |

35.26 |

35.08 |

16-Sep |

Updated 10.6.09:

The

Market has increased aggressively recently, it has

moved back above longer term resistance again, and

we needed to take action. We experienced a few

stops, and ended the day in DDM.

|

6-Oct |

DDM |

38.03 |

|

|

|

6-Oct |

DXD |

35.05 |

34.87 |

6-Oct |

|

6-Oct |

DDM |

38.02 |

37.82 |

6-Oct |

|

30-Sep |

DXD |

35.07 |

34.89 |

6-Oct |

|

30-Sep |

DDM |

38.16 |

37.95 |

30-Sep |

|

30-Sep |

DXD |

34.87 |

34.67 |

30-Sep |

|

28-Sep |

DDM |

38.16 |

37.96 |

30-Sep |

|

24-Sep |

DXD |

35.08 |

34.9 |

28-Sep |

|

16-Sep |

DDM |

38.23 |

38.03 |

24-Sep |

|

15-Sep |

DXD |

35.26 |

35.08 |

16-Sep |

Updated 10.1.09:

The

Market has begun to decline. Our 10% profit

stop threshold is 38.57. If DXD increases to

this level, set a profit stop at 38.49 and let the

position ride. If the position stops, revert

to the existing parameters and our defined rule.

However, if the Market continues to fall instead,

and if the Market tests 9040 and we are still

holding DXD, sell DXD at that level instead, and

then revert to the rules. A test is 25 market

points as usual.

Updated 9.30.09:

The

strategic plan had a busy day today. 3 stops

occurred.

We

should be long DXD.

|

30-Sep |

DXD |

35.07 |

|

|

|

30-Sep |

DDM |

38.16 |

37.95 |

30-Sep |

|

30-Sep |

DXD |

34.87 |

34.67 |

30-Sep |

|

28-Sep |

DDM |

38.16 |

37.96 |

30-Sep |

|

24-Sep |

DXD |

35.08 |

34.9 |

28-Sep |

|

16-Sep |

DDM |

38.23 |

38.03 |

24-Sep |

|

15-Sep |

DXD |

35.26 |

35.08 |

16-Sep |

Updated 9.28.09

DXD

stopped and we reverted back to DDM

|

28-Sep |

DDM |

38.16 |

|

|

|

24-Sep |

DXD |

35.08 |

34.9 |

28-Sep |

|

16-Sep |

DDM |

38.23 |

38.03 |

24-Sep |

|

15-Sep |

DXD |

35.26 |

35.08 |

16-Sep |

Updated 9.24.09:

DDM

stopped and we converted to DXD.

|

24-Sep |

DXD |

35.08 |

|

|

|

|

|

16-Sep |

DDM |

38.23 |

38.03 |

24-Sep |

|

|

|

15-Sep |

DXD |

35.26 |

35.08 |

16-Sep |

|

|

Updated 9.16.09:

DXD

stopped, and we converted to DDM. We should be

holding DDM according to rule. We should have

a 0.5% stop loss in place.

|

16-Sep |

DDM |

38.23 |

|

|

|

|

|

15-Sep |

DXD |

35.26 |

35.08 |

16-Sep |

|

|

Updated 9.15.09:

The

next phase of the Strategic Plan began when 9728 as

tested in the Dow. According to plan, DXD was

triggered as a long position with a 0.5% stop loss

and conversion strategy incorporated to control risk

and transition with the Market if needed. This

is part of the underlying strategy. If we are

stopped, we should revert to the rules, and the

qualifications associated with them.

Estimated entry level = $35.26. Associated

stop would be $35.08

Updated 9.10.09:

Strategic Plan.

Warning: Do not trade

the Strategic Plan until you have watched one phase from start to finish.

This year:

-

Return: +38%

-

Days in cash: over

100

-

Number of trades: 45

-

Trades at major

inflections points exclusively.

-

Long/Short Strategy

-

Designed as a Proactive

Alternative to Buy and Hold

-

Trades long and short

-

Uses ETFs: DDM and DXD

-

Focuses on the Dow

This is an excellent

strategy, and it works very well. However, many people fail to use it

properly if they fail to understand how to use it first. Therefore, either

wait, watch, and paper trade along with the rest of us, or take Boot Camp and

learn how to do it before committing real money, or do both.

We are rapidly approaching

9728. This will trigger the next phase of the Strategic Plan. If you

are trading, or paper trading along with us, please follow the rules outlined on

the Strategic Plan page, under Strategies on the Beta Site. A trigger will become official if the Market comes within

25 points of 9728, and then our conversion rules will fall into place. If

you are using real money, you should know these rules already.

Updated 8.31.09:

We

secured a gain in the most recent phase of our

strategic plan today. We locked in 9.43%, but

our net was only about 2%. This was the

toughest phase of the Strategic Plan to date.

There were a series of stops before the Market

moved. Most of these happened in one day, when

the Market floundered endlessly. In any case,

the Strategic Plan is now +38% YTD, we are in cash,

and we are waiting for the next trigger.

|

YTD Return: |

Strategic |

Plan = |

38.03% |

|

|

|

|

|

|

|

|

|

|

|

|

Enter date |

ETF |

Enter price |

Exit price |

Exit Date |

Difference |

% return |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

29-Jul |

DDM |

32.89 |

35.99 |

31-Aug |

3.1 |

9.43% |

|

29-Jul |

DXD |

41.48 |

41.26 |

29-Jul |

-0.22 |

-0.53% |

|

29-Jul |

DDM |

32.86 |

32.7 |

29-Jul |

-0.16 |

-0.49% |

|

29-Jul |

DXD |

41.49 |

41.28 |

29-Jul |

-0.21 |

-0.51% |

|

29-Jul |

DDM |

32.87 |

32.69 |

29-Jul |

-0.18 |

-0.55% |

|

29-Jul |

DXD |

41.49 |

41.28 |

29-Jul |

-0.21 |

-0.51% |

|

29-Jul |

DDM |

32.89 |

32.7 |

29-Jul |

-0.19 |

-0.58% |

|

29-Jul |

DXD |

41.51 |

41.28 |

29-Jul |

-0.23 |

-0.55% |

|

28-Jul |

DDM |

32.86 |

32.69 |

29-Jul |

-0.17 |

-0.52% |

|

28-Jul |

DXD |

41.5 |

41.29 |

28-Jul |

-0.21 |

-0.51% |

|

24-Jul |

DDM |

32.87 |

32.69 |

28-Jul |

-0.18 |

-0.55% |

|

24-Jul |

DXD |

41.5 |

41.28 |

24-Jul |

-0.22 |

-0.53% |

|

23-Jul |

DDM |

32.85 |

32.66 |

24-Jul |

-0.19 |

-0.58% |

|

23-Jul |

DXD |

41.55 |

41.34 |

23-Jul |

-0.21 |

-0.51% |

|

23-Jul |

DXD |

41.74 |

41.53 |

23-Jul |

-0.21 |

-0.50% |

Updated 8.21.09:

I have lowered the

upside parameter slightly. The new array is:

Dow parameters for

Strategic Plan: 7191 - 8052 - 9040 - 9728 - 10745

I changed 9749 to

9728. Otherwise the parameters are the same.

Given Friday's

move, we have now initiated a profit stop in the

Strategic Plan. If we are stopped, we will

secure gains of about 10%. However, there is

another possibility. We have not had this

happen before. Therefore, what I say here sets

precedence. We have always taken profits

before the Market moved from one parameter to

another, so we never had a case where we were

holding a position when a new parameter was tested.

Interestingly, that could happen in this phase of

the Strategic Plan.

If the Market tests

9728 and we are still in DDM from when the Market

was near 9040, we should sell DDM and revert back to

the rules. A test means that the Market is

within 25 points of 9728. Therefore, if the

Market is between 9703 and 9728, and we are still in

DDM, sell it, and if the Market is still within 25

points, buy DXD and revert back to the rules.

That would be about a 15% return from our entry,

offset by our stops of course.

8.21.09

We now have a

profit stop in DDM just under $36. If DDM gets

to $37.8 we will increase our profit stop to $37.6.

That is about 5%. This falls in line with the

5% trailing profit stop rule.

8.3.09

We are very close to setting a profit stop in the

Strategic Plan. We will start to consider this

when we are 10% in the Money. Our DDM entry

was 32.89. 10% equates to $36.17.

Therefore, if DDM equals $36.17 in the near future

set a stop loss at $35.99 and let the position ride.

If it stops, close the position and revert back to

the rules, and wait for a new trigger according to

the rules. However, if the Market and DDM move

higher after our profit stop is implemented, we will

adjust it up every 5%. Therefore, at $37.8 we

will adjust the profit stop higher, and continue to

do so every 5% until the profit stop hits or until

9642 is tested.

8.16.09

Our

Strategic Plan Parameters have changed. They

are now:

Dow parameters for

Strategic Plan: 7191 - 8052 - 9040 - 9749 - 10745

Those should be used to guide trading decisions from

here. Unless they are changed, and those

updates are listed, the data points above will act

as trigger points.

7.29.09:

|

YTD Return: |

Strategic |

Plan = |

35.99% |

|

|

|

|

|

|

|

|

|

|

|

|

Enter date |

ETF |

Enter price |

Exit price |

Exit Date |

Difference |

% return |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

29-Jul |

DDM |

32.89 |

|

|

|

|

|

29-Jul |

DXD |

41.48 |

41.26 |

29-Jul |

-0.22 |

-0.53% |

|

29-Jul |

DDM |

32.86 |

32.7 |

29-Jul |

-0.16 |

-0.49% |

|

29-Jul |

DXD |

41.49 |

41.28 |

29-Jul |

-0.21 |

-0.51% |

|

29-Jul |

DDM |

32.87 |

32.69 |

29-Jul |

-0.18 |

-0.55% |

|

29-Jul |

DXD |

41.49 |

41.28 |

29-Jul |

-0.21 |

-0.51% |

|

29-Jul |

DDM |

32.89 |

32.7 |

29-Jul |

-0.19 |

-0.58% |

|

29-Jul |

DXD |

41.51 |

41.28 |

29-Jul |

-0.23 |

-0.55% |

|

28-Jul |

DDM |

32.86 |

32.69 |

29-Jul |

-0.17 |

-0.52% |

|

28-Jul |

DXD |

41.5 |

41.29 |

28-Jul |

-0.21 |

-0.51% |

|

24-Jul |

DDM |

32.87 |

32.69 |

28-Jul |

-0.18 |

-0.55% |

|

24-Jul |

DXD |

41.5 |

41.28 |

24-Jul |

-0.22 |

-0.53% |

|

23-Jul |

DDM |

32.85 |

32.66 |

24-Jul |

-0.19 |

-0.58% |

|

23-Jul |

DXD |

41.55 |

41.34 |

23-Jul |

-0.21 |

-0.51% |

|

23-Jul |

DXD |

41.74 |

41.53 |

23-Jul |

-0.21 |

-0.50% |

|

30-Mar |

DDM |

22.51 |

25.99 |

2-Apr |

3.48 |

15.46% |

7.28.09

|

Enter date |

ETF |

Enter price |

Exit price |

Exit Date |

Difference |

% return |

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

28-Jul |

DDM |

32.86 |

open |

|

|

|

|

28-Jul |

DXD |

41.5 |

41.29 |

28-Jul |

-0.21 |

-0.51% |

|

24-Jul |

DDM |

32.87 |

32.69 |

28-Jul |

-0.18 |

-0.55% |

|

24-Jul |

DXD |

41.5 |

41.28 |

24-Jul |

-0.22 |

-0.53% |

|

23-Jul |

DDM |

32.85 |

32.66 |

24-Jul |

-0.19 |

-0.58% |

|

23-Jul |

DXD |

41.55 |

41.34 |

23-Jul |

-0.21 |

-0.51% |

|

23-Jul |

DXD |

41.74 |

41.53 |

23-Jul |

-0.21 |

-0.50% |

7.26.09

Our current

Strategic Plan has been traded as follows thus far:

|

24-Jul |

DDM |

32.87 |

|

|

|

|

|

24-Jul |

DXD |

41.5 |

41.28 |

24-Jul |

-0.22 |

-0.53% |

|

23-Jul |

DDM |

32.85 |

32.66 |

24-Jul |

-0.19 |

-0.58% |

|

23-Jul |

DXD |

41.55 |

41.34 |

23-Jul |

-0.21 |

-0.51% |

|

23-Jul |

DXD |

41.74 |

41.53 |

23-Jul |

-0.21 |

-0.50% |

7.26.09

Our Strategic

plan Parameters have changed slightly. They are now:

8077 - 9039 -

9642 - 10823

7.23.09:

The Strategic

Plan is active. We are in a position. Here are

the trades we have made YTD:

|

YTD Return: |

Strategic |

Plan = |

35.99% |

|

|

|

| |

|

|

|

|

|

|

|

Enter date |

ETF |

Enter price |

Exit price |

Exit Date |

Difference |

% return |

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

23-Jul |

DDM |

32.85 |

|

|

|

|

|

23-Jul |

DXD |

41.55 |

41.34 |

23-Jul |

|

|

|

23-Jul |

DXD |

41.74 |

41.53 |

23-Jul |

|

|

|

30-Mar |

DDM |

22.51 |

25.99 |

2-Apr |

3.48 |

15.46% |

|

30-Mar |

DXD |

65.69 |

65.35 |

30-Mar |

-0.34 |

-0.52% |

|

30-Mar |

DDM |

22.5 |

22.38 |

30-Mar |

-0.12 |

-0.53% |

|

23-Mar |

DDM |

22.68 |

24.98 |

26-Mar |

2.3 |

10.14% |

|

23-Mar |

DXD |

67.59 |

67.23 |

23-Mar |

-0.36 |

-0.53% |

|

23-Mar |

DDM |

22.67 |

22.54 |

23-Mar |

-0.13 |

-0.57% |

|

20-Mar |

DXD |

67.63 |

67.16 |

23-Mar |

-0.47 |

-0.69% |

|

20-Mar |

DDM |

22.73 |

22.61 |

20-Mar |

-0.12 |

-0.53% |

|

20-Mar |

DXD |

67.56 |

67.2 |

20-Mar |

-0.36 |

-0.53% |

|

19-Mar |

DXD |

67.85 |

67.3 |

20-Mar |

-0.55 |

-0.81% |

|

19-Mar |

DDM |

22.68 |

22.52 |

19-Mar |

-0.16 |

-0.71% |

|

19-Mar |

DXD |

67.86 |

67.48 |

19-Mar |

-0.38 |

-0.56% |

|

18-Mar |

DDM |

22.66 |

22.54 |

19-Mar |

-0.12 |

-0.53% |

|

18-Mar |

DXD |

67.68 |

67.33 |

18-Mar |

-0.35 |

-0.52% |

|

18-Mar |

DDM |

22.79 |

22.67 |

18-Mar |

-0.12 |

-0.53% |

|

18-Mar |

DXD |

67.52 |

66.63 |

18-Mar |

-0.89 |

-1.32% |

|

20-Feb |

DXD |

70.6 |

77.65 |

27-Feb |

7.05 |

9.99% |

|

20-Feb |

DDM |

22.95 |

22.8 |

20-Feb |

-0.15 |

-0.65% |

|

20-Feb |

DXD |

70.78 |

70.39 |

20-Feb |

-0.39 |

-0.55% |

|

19-Feb |

DDM |

23.05 |

22.22 |

20-Feb |

-0.83 |

-3.60% |

|

6-Jan |

DXD |

50.38 |

60.44 |

14-Jan |

10.06 |

19.97% |

|

6-Jan |

DDM |

33.91 |

33.74 |

6-Jan |

-0.17 |

-0.50% |

|

6-Jan |

DXD |

50.4 |

50.1 |

6-Jan |

-0.3 |

-0.60% |

|

6-Jan |

DDM |

33.93 |

33.76 |

6-Jan |

-0.17 |

-0.50% |

|

6-Jan |

DXD |

50.44 |

50.16 |

6-Jan |

-0.28 |

-0.56% |

|

6-Jan |

DDM |

33.84 |

33.65 |

6-Jan |

-0.19 |

-0.56% |

|

5-Jan |

DXD |

50.55 |

50.23 |

6-Jan |

-0.32 |

-0.63% |

|

5-Jan |

DDM |

33.84 |

33.64 |

5-Jan |

-0.2 |

-0.59% |

|

5-Jan |

DXD |

50.55 |

50.24 |

5-Jan |

-0.31 |

-0.61% |

|

2-Jan |

DDM |

33.78 |

33.33 |

5-Jan |

-0.45 |

-1.33% |

7.23.09:

This is an

easy to understand visual explanation:

http://www.stocktradersdaily.com/clubsite/Club/Strategic%20Plan/strategicplan721092/strategicplan721092.htm

7.21.09

Parameters:

Dow parameters for Strategic Plan:

6525 - 7191 - 8052 - 9039 - 9716

The Dow

Jones industrial average is approaching longer-term

resistance. Recently, it came within 10 points of our

defined longer-term support level. Now, suddenly, a

test a longer-term resistance lines looks imminent.

Longer-term resistance as defined in our strategic plan is

9039 for the Dow Jones industrial average. The

instructions below explain exactly how we should trade the

strategic plan based on the expected test of 9039. Use

it to guide your trades.

Instructions:

-

As soon as the Market falls

between 9014 and 9039 buy DXD.

-

Do not wait, use market orders,

and do not second guess your decision.

-

Immediately set a 0.5% stop loss

based on your fill, not on market levels.

-

If you are stopped, see where

the Market is and use the rules.

-

If the Market is within 25

points of 9039 again, buy either DDM or DXD

-

DDM will be bought if the Market

is > 9039 and < 9064

-

DXD will be bought if the Market

is > 9014 and < 9039

-

If a stop and second buy occurs,

use a 0.5% stop again and repeat.

-

If another stop occurs, start at

rule #5 and work forward.

-

Continue to convert until the

Market makes up its mind on direction.

-

This may take a few days.

We may incur multiple stops.

-

Once the Market begins to move,

look to secure gains.

-

When your position is in the

money by 10% set a profit stop.

-

Additional guidelines will be

provided when that happens.

-

DO NOT use too much money.

DO NOT have expectations.

-

You must pay attention for a few

days.

-

After we secure gains we will

revert to cash again.

7.7.09:

With a test of

8052 coming, we should be ready to engage the next phase of

the Strategic Plan. Consider these both instructions

and warnings. First, do not think the Strategic Plan

is easy to follow. +36% YTD on 29 trades, and in cash

for over 90 days sounds great, but the Strategy is not easy

to follow unless you are disciplined. Stops will

occur, small losses will need to be realized, and the plan

should be followed precisely, otherwise it will not be

effective. If it is followed, the plan will work like

it has in the past.

Instructions:

-

As soon as

the Market falls between 8052 and 8077 buy DDM.

-

Do not wait,

use market orders, and do not second guess your

decision.

-

Immediately

set a 0.5% stop loss based on your fill, not on market

levels.

-

If you are

stopped, see where the Market is and use the rules.

-

If the

Market is within 25 points of 8052 again, buy either DDM

or DXD

-

DDM will be

bought if the Market is > 8052 and < 8077

-

DXD will be

bought if the Market is > 8027 and < 8052

-

If a stop

and second buy occurs, use a 0.5% stop again and repeat.

-

If another

stop occurs, start at rule #5 and work forward.

-

Continue to

convert until the Market makes up its mind on direction.

-

This may

take a few days. We may incur multiple stops.

-

Once the

Market begins to move, look to secure gains.

-

When your

position is in the money by 10% set a profit stop.

-

Additional

guidelines will be provided when that happens.

-

DO NOT use

too much money. DO NOT have expectations.

-

You must pay

attention for a few days.

-

After we

secure gains we will revert to cash again.

6.9.09

Our Economic

analysis has been updated, and it now extends beyond 2010

with this current report. It is titled: The Grimm

Reaper is Knocking. It uses the Investment Rate to

compare current demand ratios to normalized demand ratios to

gauge future economic activity. This was the same

basis used in the Return to Parity Analysis issued in

December, 2008. It also references the PST and TBT

positions that were recommended in December, and the UYG and

URE positions that were recommended the day after the Market

bottomed in March. This is a must read for everyone

because it sets the tone for the next six months.

The Grimm Reaper is Knocking

Updated 5.3.09

our combined

longer-term analysis has been updated and the signals

stemming from our revised analysis will act as the trigger

points for our strategic plan going forward. All

charts, The longer term charts of the Dow, the S&P 500, and

the NASDAQ are congruent. They show the same general

patterns and together they provide an outline for market

direction throughout 2009. This analysis should be

used in conjunction with my return to parity analysis.

This is important because it lays the groundwork for our

decisions going forward.

I have prepared

a presentation explains my outlook for the remainder of

2009. Please take the time to review this

presentation. It will only take a few minutes.

http://www.stocktradersdaily.com/2009Strategy/player.html

Strategic Plan:

Dow parameters for Strategic Plan:

6525 - 7191 - 8052 - 9039 - 9716

Updated 4.7.09:

our combined

longer-term analysis tells us that the market may decline

and the Dow Jones industrial average may re test converted

longer-term support levels. Watch 7441 closely.

Our strategic plan is currently in cash, but if 7441 is

tested we should engage the strategy again. Use the

following plan to guide the trades in the strategic plan if

7441 is tested again:

Dow parameters for Strategic Plan:

6385 - 7441 - 9054 - 10800

Strategic Plan:

-

If The Market comes within 25

points of 7441 buy DDM (7441 - 7466)

-

Set a 0.5% stop loss. This

will stop below 7441 if rule #1 is followed.

-

If a stop occurs convert to DXD

with the same 0.5% stop loss.

-

If another stop occurs convert back to

DDM.

-

Repeat this process as many

times as needed.

-

Expect a few stops, but the

losses are small.

-

After a few times, expect the

Market to follow through.

-

We do not know the direction it

will go.

-

When 10% in gains are realized

set a trailing profit stop.

-

Review the Strategic Plan link

for examples of past trades

Updated 4.2.09

Dow parameters for Strategic Plan:

6385 - 7441 - 9054 - 10800

Strategic Plan:

We locked in 15.46% today.

Great Job!

|

YTD Return: |

Strategic |

Plan = |

35.99% |

|

|

|

| |

|

|

|

|

|

|

|

Enter date |

ETF |

Enter price |

Exit price |

Exit Date |

Difference |

% return |

| |

|

|

|

|

|

|

|

30-Mar |

DDM |

22.51 |

25.99 |

2-Apr |

3.48 |

15.46% |

|

30-Mar |

DXD |

65.69 |

65.35 |

30-Mar |

-0.34 |

-0.52% |

|

30-Mar |

DDM |

22.5 |

22.38 |

30-Mar |

-0.12 |

-0.53% |

Updated 4.1.09

The Strategic

Plan is approaching our lock - in of 10%. We must now

incorporate the Profit Stop Rule.

Here is a plan to initiate profit stops in the strategic

plan:

-

If DDM gets to 25.1 set a stop at 24.99 and leave it

there. Do not trail. If it dips the profit stop

will trigger.

-

If DDM gets to 26.1 move the stop up to 25.99 and

leave it there

-

If DDM gets to 27.1, repeat.

-

Continue to do this until the profit stop hit

Longer term support in the Dow Jones

industrial average was tested again and new triggers occurred for the strategic

plan. Our combined longer-term analysis continues to tell us that higher

levels of lie ahead so long as 7441 remains in tact as support in the Dow.

Treat that as a key level of inflection. If this support level remains

intact all three markets are likely to trend higher quite aggressively over

time. This is an inflection level for longer term positions, and the test

that occurred on Monday began the next phase of our strategic plan.

Currently, we should have a long bias with an upside target of 9054. This

will hold unless 7441 breaks lower. The strategic plan is a well defined

risk controlled strategy using market-based ETFs. The trades that have

occurred as far, since Monday, are listed below. The details regarding the

strategy are found in the Strategic Plan page in the main menu of our website.

Dow parameters for Strategic Plan:

6385 - 7441 - 9054 - 10800

|

YTD Return: |

Strategic |

Plan = |

21.58% |

|

|

|

|

|

|

|

|

|

|

|

|

Enter date |

ETF |

Enter price |

Exit price |

Exit Date |

Difference |

% return |

|

|

|

|

|

|

|

|

|

30-Mar |

DDM |

22.51 |

open |

|

|

|

|

30-Mar |

DXD |

65.69 |

65.35 |

30-Mar |

-0.34 |

-0.52% |

|

30-Mar |

DDM |

22.5 |

22.38 |

30-Mar |

-0.12 |

-0.53% |

Updated 3.26.09

Our combined

longer term analysis tells us that the market has broken

above longer term resistance and is poised to accelerate

over time until it tests secondary resistance levels.

The resistance levels which were recently broken have now

been converted into support and they still are considered

inflection parameters. Our current analysis tells us

to expect the market to trend higher, but it may not trend

higher with out backing and filling along the way. In

fact, a retest of recently broken resistance, which is now

converted support, may even occur before an official test of

secondary resistance levels happen.

STRATEGIC PLAN:

The most recent

phase of our recent strategic plan was closed with a modest

gain. All strategic plan participants should now be in

cash. We will not trade again until such time as one

of our established parameters are tested. These are

subject to change, but the parameters are listed below.

For those persons following the strategic plan, we should

appreciate the cash position. The strategic plan is

currently up more than 21% YTD, and we have been in cash

most of the time. Best of all, we have been able to

make money regardless of market direction, and we have

always remained in control of our risk. This will not

change, and this is why we have performed well this year.

It is why we perform well every year. Do not become

overwhelmed with current market conditions. It does

not matter to you. The strategic plan is one of the

best ways of making money in any market environment, and all

it takes is a little focus. Do not cave to emotions

and risk! If 7440 is tested again in the Dow we will

re-engage the strategy. otherwise, we wait for 9054.

Dow parameters

for Strategic Plan: 6385 - 7440 - 9054 - 10800

|

YTD Return: |

Strategic |

Plan = |

21.58% |

|

|

|

| |

|

|

|

|

|

|

|

Enter date |

ETF |

Enter price |

Exit price |

Exit Date |

Difference |

% return |

| |

|

|

|

|

|

|

|

23-Mar |

DDM |

22.68 |

24.98 |

26-Mar |

2.3 |

10.14% |

|

23-Mar |

DXD |

67.59 |

67.23 |

23-Mar |

-0.36 |

-0.53% |

|

23-Mar |

DDM |

22.67 |

22.54 |

23-Mar |

-0.13 |

-0.57% |

|

20-Mar |

DXD |

67.63 |

67.16 |

23-Mar |

-0.47 |

-0.69% |

|

20-Mar |

DDM |

22.73 |

22.61 |

20-Mar |

-0.12 |

-0.53% |

|

20-Mar |

DXD |

67.56 |

67.2 |