Find our current and future

evaluations of the US economy on this page.

This is a straight forward

approach to Economics.

The foundation for our economic

analysis is the Investment Rate. The first step in evaluating

economic conditions is to evaluate longer term economic cycles.

The Investment Rate is the most accurate leading longer-term

economic and stock market indicator available.

Because The Investment Rate is

a long term indicator, some might not think that it is

appropriate to use when identifying short term cycles.

However, we have successfully done that. The Investment

Rate represents normalized demand trends, so when we compare

immediate demand levels to those normalized trends, we can

determine if demand will increase, or weaken in the next 6-12

month span. This helps with both business decisions, and

investment decisions. Find examples in the 2009 return to

Parity analysis, and the 2010 Forecasts.

Our current and future

evaluation of the economy:

Updated 4.14.10:

The current state of the consumer:

Several weeks ago, I balked at the

negative consumer sentiment number. I saw activity, I saw

happier faces, and I saw pocketbooks being opened, so that

negative number did not reflect the real current economy in my

opinion. The activity at that time was quite good. After a

long layoff and a roller coaster ride that would make Magic

Mountain shake, consumers came back a few months ago.

When I questioned that report, and

suggested that you discount it completely, I did so because I

saw a surge in activity. Not only did it stabilize, but many

consumers also came back with force. I could argue that many

women finally got the opportunity to shop again, but that would

separate men, who also were out in droves. Everyone seemed to

have a pent up desire to spend.

Is this human nature? When we are

forced not to spend, do we want to do it more and more. And if

so, when we get the green light to spend again will we clamor

over each other to reach the cash register? My current views

shed some light on those questions.

At this time, from my observations,

the surge in consumer re-participation is abating. They were

strong a month ago, and that lead to my former conclusion.

Since then, they have backed off.

With that, we are probably going to

have stronger confidence numbers, and analysts are probably

going to be late to the game again, but I see reasons to be

concerned, not reasons to be in frenzy. If we receive a report

in the next few days or weeks from some analyst or news agency

that suggests consumers are going to accelerate spending, I will

balk at that too.

My observations suggest that

consumers came out of the gates aggressively, but the turnout

now is much lower. Some are still there, much more than a year

ago, but the numbers are less than a month ago. People are just

not as interested because they have gotten that spending bug out

of their system already. Now, it is back to reality.

Therein lays the problem. The

consumer had a pent up demand, they acted on that emotion, and

now they are coming to tough conclusions again. Many of them

are realizing that they cannot afford to keep up that pace.

Shocking! America is finding the need to budget, at least many

consumers are.

If they are given a compelling

reason, I am sure some consumers might step up to the plate

again, but without that, I am seeing signs of tightening. I am

observing a restraint that was not there a month ago. From

that, I believe the future data will reflect an abatement of

demand.

The Overshoot

This fits directly in line with our

overshoot. Clearly, I have been preparing you for this

overshoot for a long time now. I have also been talking about

the Investment Rate and its accuracy for eight years. To you

commercial real estate buyers out there, who are not getting the

deal of the century on a foreclosed property you can turn around

and sell immediately for a profit, think twice. Think twice

about buying at the tail end of this overshoot, and think twice

about doing it in the first couple of years of the third major

down period in US History too.

The observations I am making now fit

in line because the data we will see will lag. The data will

not show the signs of a consumer pullback until the data shows

signs of consumer re-participation first. Yes, we are starting

to get data that shows that now, but there will be more before

it is over. That could help push us to the overshoot we are

looking for, and give us that opportunity to short we are

measuring.

Like a boxer using a straight arm, I

am measuring our course of action, and laying the groundwork for

what I think will be exceptional positions soon. For those who

were members in January, can you remember what I said the best

trade of the year would be? If you do not know, I will talk

about it soon. If you do know, prove it and respond to this

email with your guess.

With more positive consumer data on

the horizon, and a clear abatement taking place in real time, I

am looking for an overshoot, and then a taste of reality. After

this positive data, a turn down will come. When it does, Wall

Street will be hit again.

However, I cannot say that smart

money will lead the way. In fact, many smart money investors,

at least those who I thought I respected as being ahead of the

curve always, seem to be falling prey to the Market just like

everyone else. The proactive approach that has been proven for

years is once again being discounted by the masses, but some

smart money investors seem to be doing the same thing. Maybe

that is because they own some assets at extremely low levels.

My guess is, it is because they want to own more assets at those

low levels, they are in search of those opportunities still, and

they have forgotten about securing gains in the assets that have

already appreciated.

All classes of investor are being

dragged back in. This is exactly what we have been waiting

for. These are the classic signs of an overshoot. We have been

bullish, we have been on the long side, we have been riding the

wave up, but because we do not care about direction, we can also

turn on a dime. That is what proactive investing is all about.

When you tie your assets up in investments that depend on a

stronger economy or a higher market, our proactive approach does

not satisfy your emotion anymore.

In the end, I have not designed our

system to satisfy emotions. I designed them to rid us of

emotional burdens instead. If you are emotional, if you are

giddy, if you are nervous, stop. Sit back, relax, and let them

come. I am watching, I will always be watching, and I will

always do my best to keep you ahead of the curve too. Stay

proactive, stay liquid, stay on the course. We have been

planning for this, it is happening now, and we will take

advantage of it.

Updated 1.27.10:

I am backing off

of my inflation outlook. There may be reflation, and there

may be an attempt to solidify pricing power by some companies,

but very few will have the ability to do it.

Instead, and much more probably, price wars will take place.

We are already seeing it in the Verizon versus At&T battle.

Soon, cellular phone service will be a commodity.

Many other

expensive services will experience deflationary pressures as

competitive pressures change the playing field too. Growth

will not come from cost cutting anymore, prices will be hard to

increase, so the logical alternative from a corporate standpoint

is to increase market share. Some companies can afford to

slash prices. This will cripple income streams, but it

will also cripple their competitors. Gaining market share

is the name of the game in 2010. I expect to see more VZ -

T like battles. Then, I expect to see acquisitions.

Updated 1.14.10

Our economy is on the verge of

hitting a Wall. The recovery in 2009 was expected, and we

profited from it. From here, the prevailing headwinds will

soon start to take over. The excitement of the rebound

will only last a short while longer, if at all. However,

there could be another surge in the Market without better

economic signals, but it will not last. I do expect the

Economic signals to stop showing positive signs very soon, and

once that happens I expect investors to start to get nervous.

True nervousness will probably not set in until the latter part

of the year. Until then, the Market should ebb and flow,

while investors hope for the best. They will not get what

they want, if they are dependent on a continual increase.

The stagnating econometric

variables will be the first sign that the economy will continue

to weaken. The Market will not become truly nervous until

a series of stagnant economic data comes, and then start to

weaken too.

The year should shape up in line

with this general economic view.

We are still holding TBT, but GLD

was sold as referenced in our position trades link.

Updated 12.30.09

2010 - The Year of

the Increase

This is our

forecast for 2010.

http://www.stocktradersdaily.com/reports/2010.pdf

Updated

8.29.09:

|

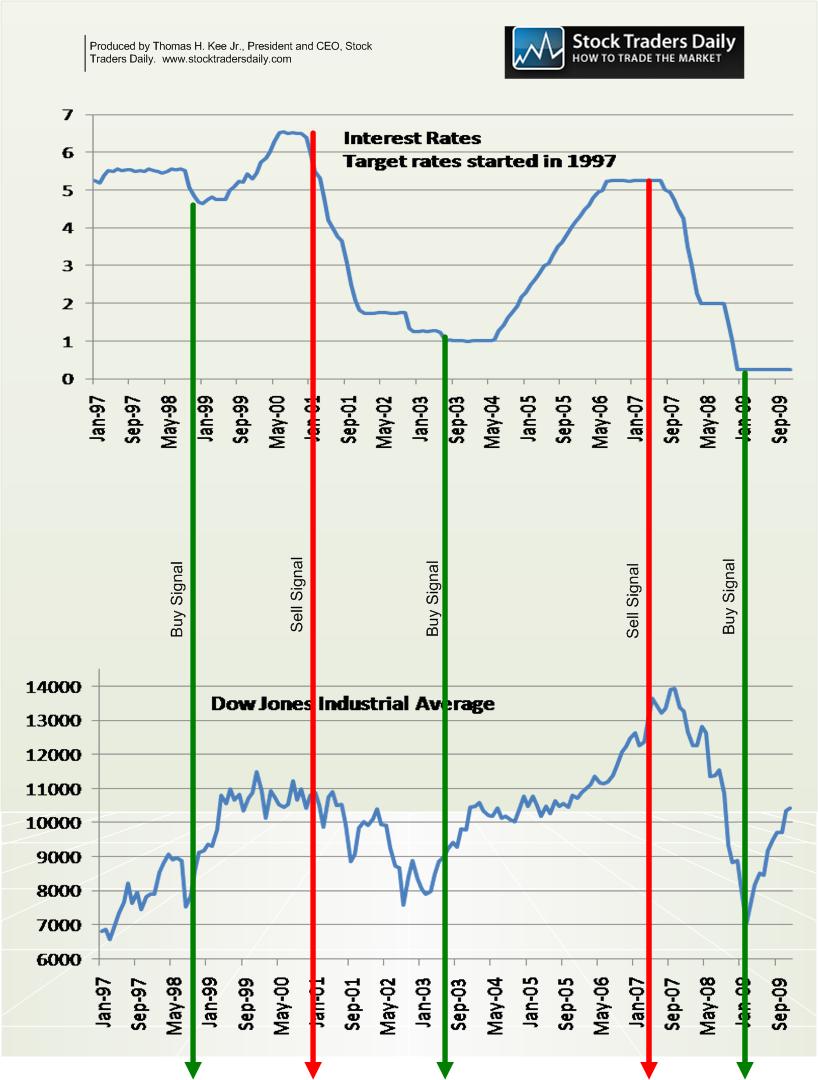

My Reconciliation is based on a shift in an established

long-term pattern. Specifically, I am referencing the

relationship between interest rates and the stock

market. Since the FOMC began using the target rate in

1997, the Stock Market has been lead by the transition

in Interest Rate policy.

For years, I have

been offering updated graphs, which show that we should

be buying when interest rates stop being cut, and

throughout the raising cycle. Then, we should sell and

begin shorting the moment interest rates begin to be

cut. The charts below show this relationship through

October 2008. With projections you can see, if you

bought when the last cut was made in 2008 you are doing

okay yet again. This relationship has held for a long

time.

This relationship

exists because Interest Rates were being adjusted due to

the relative strength or weakness in the economy. In

fact, very little concern was paid to inflation.

Although I would argue this decision, non-core

inflationary concerns were not driving the decision of

the FOMC. As a result, they raised rates during strong

times, and the Market increased during those strong

times too. Conversely, they cut rates during weak

times, and the Market declined just as we would expect.

As we know, the market goes up when the economy is

strong, and it goes down when the economy is weak. This

is not rocket science, even though Wall Street did not

seem to be able to see the forest despite the trees;

everyone wanted to argue this steadfast point every time

it was made. This relationship

exists because Interest Rates were being adjusted due to

the relative strength or weakness in the economy. In

fact, very little concern was paid to inflation.

Although I would argue this decision, non-core

inflationary concerns were not driving the decision of

the FOMC. As a result, they raised rates during strong

times, and the Market increased during those strong

times too. Conversely, they cut rates during weak

times, and the Market declined just as we would expect.

As we know, the market goes up when the economy is

strong, and it goes down when the economy is weak. This

is not rocket science, even though Wall Street did not

seem to be able to see the forest despite the trees;

everyone wanted to argue this steadfast point every time

it was made.

Regardless, this

relationship only holds true when the determinate is

economic strength or weakness exclusively. When

inflation is factored in, the parity we have been

witness to dissolves. In the next cycle, that

relationship will dissolve. In this next cycle, a

shift in the long term established parity between

interest rates and the direction of the stock market

will occur.

The reason is

inflation!

The Economy is

entering an inflationary period, and as 2010 comes,

inflation will become a major concern. That will break

the relationship I have identified for so many years.

Here is how it

will unfold:

First, Wall Street

is found on the premise of increasing revenues. Most

companies have been able to quell critics recently with

cost cutting. We all know, that can only last for so

long. The next question is growth. When will real

growth come back? That is the tuff part. Everyone is

asking that question, but very few have a sound

response.

We know:

1.

The pool of potential

consumers has shrunk (layoffs)

2.

The remaining consumers

have been saving (increased savings rate)

3.

Companies will have trouble

selling more because there will be fewer buyers

4.

Companies will need to show

better results.

With pressure from

their investors, companies will struggle to look for

ways of bettering results. They will not be able to

sell more goods than they are now, because the number of

potential buyers has declined, and unless credit eases

substantially again (it will not) or the unemployment

rate suddenly shrinks (it will not), the numbers of

buyers will remain the same, and not grow.

If growth by adding

volume is unlikely, many companies will find difficulty

producing increased results, because cost cutting will

no longer be acceptable. Their second option is viable

though. The current buyers will have been saving money,

and they will feel more comfortable about the economy as

2010 comes around.

The groundwork is

already laid.

Corporations will be

looking for a way to increase revenues, and they won’t

be able to do it by increasing volume. The logical

choice is to raise prices, and they will be able to do

it because consumers will accept it. This does not even

account for low interest rates, but that plays a role

too.

Instead, the simple

state of our economy will give rise to real inflationary

pressures. This will not be commodity driven, and

therefore it will not be discounted by the FOMC.

Instead, they will be forced to raise rates to curb

inflation for the first time in 10 years. That will

break the cycle outlined above, and that will cause

interest rates and the market to diverge for the first

time since the target rate began.

Inflation is on the

horizon, and there is a logical way to profit from it.

Buy Gold and

Short Treasuries.

Gold Plays:

GLD

UGL

DGL

Short-Treasury ETFs:

TBT

PST

|

Updated 8.9.09

If you have

been following my broader market observations you know that I

expect inflation to become a problem as we enter 2010.

That makes this FOMC policy decision extremely important.

Their decision to, or not to raise rates will determine the

severity of the inflation pressure in my opinion.

Unfortunately, I do not think they will act. I think many

on the committee will want to, but I think political pressures

will prevent them from taking action. Not Good!

As we enter

2010 companies will try to show positive results that are not

related to cost cutting measures. However, that will be

extremely tough. In fact, for many companies new volume

levels will stagnate. Sales volumes will not grow because

there will not be a substantial number of new consumers in the

Market. This is a big problem when the objective is to

show real growth.

However, the

consumers who are still in the Market, most of whom still have

jobs, will probably become more confident with the economy at

the same time. I expect the Market to continue to increase

through Q1/10, and that will be their rationalization.

Even though I would not be surprised to see a pullback after we

test 9642 in the Dow, I expect the Market to be much higher by

the end of the first quarter of 2010. This will create a

false sense of reality for many people.

Investors and

consumers will think that the Economy will recover swiftly as it

has for the past 26 years. Unfortunately, that will not

happen this time (Investment Rate).

My points on

that topic are left to another conversation though.

Instead, this one is focused on inflation. When 2010

comes, and companies find real growth almost impossible due to

the lack of net new buyers, they will turn to their existing

customers for growth. They can sell new products of

course, but a much easier method is to just raise prices.

After all, those customers will see that the Market is

increasing, they will have that false sense of security, and

they will be more willing to pay more for goods and services as

a result. It is a logical course of action for any

corporate executive. Raising prices is a great way to show

better numbers.

As we enter

2010, I expect inflationary pressures to be strong.

Corporate greed and the demands of Wall Street will be the

driving force. However, extremely low interest rates now

will allow that to become a reality too. Sure, real rates

are higher than the Target Rate, but they are still priced to

move. That means, companies can borrow more cheaply now

than they will be able to in the future. Everyone knows

this. In fact, that may be one of the political reasons

for leaving interest rates at their current levels right now.

If the FOMC raises rates, the US Government will also have to

pay more interest on the Treasury Bonds it issues. I think

we are having a tough time affording a rationale budget, much

less higher bond prices.

In any case,

the FOMC's decision this week will be critical. If they

raise rates by 50 basis points, I think it will be a move in the

right direction. However, I do not think they will.

I think they sit on their hands, at the request of Capital Hill.

We will find out how right I am when the minutes are released.

Initially, if

interest rates stay where they are, I expect the Market to react

positively. However, I also expect a positive result if

interest rates are increased. The first would be a relief,

but an increase would be followed by a knee jerk lower and then

a recovery on the rationalization that the Economy is improving

and allowing the FOMC to act. Either way, I expect a

positive result when the dust settles.

This

should be enough to get the Market close to 9642.

The problem

is, what happens when the decision to raise rates shifts from

one focused on economic strength or weakness, to inflation.

That is the dilemma I expect in 2010. That will break the

correlating trend between Market levels and Interest Rates that

has existed for more than 10 years. If you have not been

paying attention, the Market increases when rates are being

increased (since '98), and it has declined throughout the easing

cycles. That has only been true because every move has

been due to economic strength or weakness. When that

stops, when the decision is based on inflation again, the

correlation will stop. If rates are increased due to

inflation, I expect the Market to get hammered. That's

sets the stage for 2010.

Updated

7.23.09:

When I was a

financial advisor for Morgan Stanley, my managers held routine sales

meetings. These were often hosted by mutual funds or money managers,

who hoped to influence us to encourage our clients to invest money with

them. They always told us how to go about it. They pointed out ways we

could influence our clients to make decisions. I am going to talk about

this, and how it relates to recent history.

Yesterday, President

Obama made clear that he does not want Congress to waste time with

Health Care. All debate aside, he wants this done fast, and he has set

an agenda. If he didn’t, in his own words, nothing would get done.

That is because Congress, just like most individuals, would rather do

nothing than something. That is especially true when it means change.

That is not unique to

congress, but it is human nature. Few people would opt for the road

less traveled, even if it was logical, and purposeful. For Obama, his

goal is to correct an obvious problem, something everyone recognizes.

Still, many people would rather sit on their hands than do something

about it.

The same thing

happens when people consider investments. That is how the sales

meetings guided me, a decade or so ago. There were two emotions they

encouraged us to play on. They either wanted us to address the fear

within our clients, or the greed most of them had from time to time.

Once we tapped into the right emotion, we could direct them into

accounts that balanced their emotion, and the sales process was easy.

For example, if they

were afraid, we could pitch a bond fund. If they were greedy, we could

pitch the more aggressive fund, or the one with the best recent

performance. People love to chase performance, and it is an easy sell,

even if it is not the best approach.

Fear and Greed have

been powerful. In 2008, everyone was afraid, unless they were using our

proactive strategies of course. For those engaged in our proactive

strategies, they couldn’t care less where the Market went. Down was as

good as up, as far as they were concerned. Others lost everything, or

at least most everything. Now, as 2009 continues, the prominent

emotion is greed.

This, at least, is

true for the masses. The little guys have returned, and they are

emotional because they want it back. They want to “win it back.”

Unfortunately, we are not in Vegas, and we are not in a longer term

up-cycle anymore either. The Market has begun a prolonged decline, and

The Investment Rate tells you why. But nothing goes straight down.

Still, greedy

investors will begin to chase performance again. In fact, they already

are. Unfortunately for them, they will never change. They will end up

doing the same thing all over again, even though they know that gets

them in serious trouble. Even though they have just lost a substantial

amount of wealth using this same practice, greed prevails now, and

investors would rather stay the course and take their lumps again, than

make a change that is logical, and purposeful. Influencing people

to address risk controls is tough in this environment.

This is exactly what

Obama is facing with delayed congressional attention. In 2008,

everyone wanted proactive strategies, because they had to protect their

risk. Now, risk control seems far less important. Yet, it is more

important now than ever.

My detail has been

explicit. I warned of a severe decline in the middle of 2007, I have

outlined The Return to Parity that is happening now (I did this at the

beginning of 2009), and I have provided advanced warning that the

beginning of 2010 will mark the end of this hopeful recovery.

That does not imply

that I think the Market goes straight up from now to then. It will

trade down again. It always trades up and down along the way. The

frequencies will be important to monitor, but if the economic conditions

improve, I expect the Market to increase too. Therefore, over time I

expect the Market to head back up a little more at least.

However, it will not

get near 2007 highs again for decades.

Greedy investors are

hoping that it will. And, greedy investors are forgetting about risk

controls. Greedy investors are letting themselves repeat mistakes. But

greedy investors are not part of the leadership group either.

Therefore, they mean little to us.

We are not greedy

investors. We are risk conscious investors. We do not chase

performance, we chase risk control. That might mean we don’t get to

celebrate with everyone else when the Market experiences a surge like it

is now. However, we could. Our strategies are not correlated to Market

direction, and that is why they work regardless of market direction. We

could have a great week when the Market moves sideways, or a bad one

when the Market moves up. We could perform better than the Market from

time to time, or worse, but because we can make money in any market

environment, I expect our strategies to prevail over time.

That has already been

true.

However, our

strategies are not based on performance. They are based on risk

control. They are also designed to remove both fear and greed from the

equation. We are not afraid, because we are always in control of our

risk. And we are not greedy because we have already learned the hard

way that greedy investors will eventually pay the price.

Doing nothing is not

an option. Just like Obama is pressing Congress, I press everyone all

the time to manage their risk. That is the only way to stay ahead of

the curve in the years that lie ahead. If those risk controls are

relinquished the reversion to brackish investing will lead to wealth

deterioration if the findings of the Investment Rate hold. Still, new

members are having problems accepting risk control as a way of life.

Let greedy investors

celebrate. They are not privy to the information you have. Do not

diverge from your strategies. I know it is hard not to get caught up in

the frenzy, but I warned about this many months ago, and I have updated

comments regularly. This recent euphoria should come as no surprise.

I have outlined it, we have prepared for it, and it is happening exactly

like I suggested.

Stay focused and

remain in control of your risk.

You will be happier in the end if you do, and you will stay ahead of the

curve over time. Every day is a Tuesday means two things.

First, it means that we do not become afraid when everyone else panics,

but it also means that we do not get euphoric when everyone else is

filled with excitement. Instead, we stay the course, and approach

things the same way every day. Now is no exception. In fact,

it is more important now than ever.

Good Trading.

Thomas H. Kee Jr.

President and CEO

Stock Traders Daily.

Updated

7.21.09:

This is a

very important update:

http://www.stocktradersdaily.com/clubsite/Club/InvestmentRate/economic721092/economic721092.htm

6.9.09

Our Economic

analysis has been updated, and it now extends beyond 2010 with

this current report. It is titled: The Grimm Reaper is

Knocking. It uses the Investment Rate to compare current

demand ratios to normalized demand ratios to gauge future

economic activity. This was the same basis used in the

Return to Parity Analysis issued in December, 2008. It

also references the PST and TBT positions that were recommended

in December, and the UYG and URE positions that were recommended

the day after the Market bottomed in March. This is a must

read for everyone because it sets the tone for the next six

months.

The Grimm Reaper is Knocking

Updated 5.3.09

Economic conditions

are starting to improve as planned. From here, I expect

the Headfake outlined in the Return to Parity Analysis to be

realized. Find the Rturn to Parity in the Investment Rate

section. I have prepared a presentation explains my

outlook for the remainder of 2009. Please take the time to

review this presentation. It outlines these changes, and

will only take a few minutes.

http://www.stocktradersdaily.com/2009Strategy/player.html

2.19.09

Recent policy decisions and a Greater Depression

When Bank of America decided to Buy Countrywide last year, I

went on record. In my opinion, that was one of the worst

mistakes in the history of our Financial Markets. Now, that

opinion is starting to prove itself. Review the article here:

http://seekingalpha.com/article/59910-bofa-s-countrywide-purchase-is-a-huge-mistake

Given recent developments, I am going on record again. In my

opinion, the decisions of our new administration will lead the

US into a Greater Depression. This may be the worst mistake in

the history of the United States. The Trillions of dollars

spent to buy our way out of this mess will be wasted, and the

byproduct will stifle the economy for many years to come.

Although the purpose of the resolutions is well intended, the

consequences will be more than the country can bear. After a

sobering period of demand – side stability, the US Taxpayer will

have to pay the price. In addition, the government will not be

able to spend these monies every year to employ the 2 million

jobs referenced by President Obama in recent days.

Instead, when the spending phase is exhausted those jobs will be

lost. A perfect scenario suggests that the private sector would

then pick up those laborers. However, a debt burden will linger

over the country at the same time. Therein lays the problem.

With Social Security and Medicare bringing up the rear, the

taxes levied on the wealthiest Americans will skyrocket. This

will create a circular trap which limits reinvestment into the

economy, and which impedes growth as a result. Those laborers

will not be rehired.

In addition, and more importantly, this will happen during the

third major down period in US History. Normalized demand ratios

decline for the next 16 years, according to my proprietary

analysis. This called The Investment Rate, and it is the most

accurate leading longer-term stock market and economic indicator

ever developed.

Therefore, the result of today’s decisions will compound as

demand for new investments continues to decline. Accordingly,

the United States will be faced with the worst financial crisis

it has ever seen

Here is the timeline:

1.

-

Demand Side stability will surface in the next 6-12 months

-

The Economy will appear to be in a recovery process

-

The Target Rate will begin to increase

-

Taxes will go up

-

Economic recovery will stall

-

The declining demand ratios evidenced by the Investment Rate

will prevail.

-

Social Security and Medicare will be front and center

-

The value of the Dollar will decline.

-

Foreign interest in US assets will wane.

-

A Greater Depression will result.

The Mortgage mess was just the beginning. BAC, C, GM, and

Chrysler are all on the chopping block today. Over time, this

list will grow. This is Contemporary Darwinism at its best.

Only the strongest, most nimble companies will survive. We

cannot stop this natural selection process. We cannot prop up

weak companies. Moreover, we cannot buy our way out of this

mess. The more the US spends, the more the taxpayers lose.

Fiscal disciplines should be the focus, but that seems to be the

last thing on anyone’s mind. Didn’t we learn that lesson

already

11.2.08

I do not specialize in Real Estate, but THE INVESTMENT RATE

has a direct impact on Real Estate prices and this is an

important time to comment on that relationship.

These comments are important to:

My comments are a direct byproduct of the article I wrote on

Thursday as it relates to the current anomaly in THE

INVESTMENT RATE. If you have not read it please do so now.

Thursday's Article:

http://www.stocktradersdaily.com/News%20Release/News_release_TA_00002000800100030008arm.htm

In the above article I also elude to an anomaly in THE

INVESTMENT RATE. Last week I sent a private email to our

membership explaining that anomaly and the opportunities that

lie ahead as a result. Current members can review those

comments again using the link below.

Media and non-members should wait until my Marketwatch Article

for November is made public by Dow Jones.

Here is the Anomaly Summary:

http://www.stocktradersdaily.com/clubsite/Club/InvestmentRate/index.html

Real Estate Decisions:

I'll start with a 'shoot from the hip' assessment, and explain

my position thereafter:

I think Real Estate prices will experience a significant

increase in the next 6-12 months. If you are a seller of real

estate I would wait for 6 months because I think you will get a

better price at that time. Further, if you indeed own excess

real estate I would seriously consider a full liquidation in

6-12 months as well, because I don't expect follow through. If

you are a buyer, I would NOT be a buyer of investment property

at all. Economic conditions should improve over the next 6-12

months as real estate prices bounce back, but that will be

temporary.

The referenced articles satisfactorily explain my position on

Interest rates and the anomaly, and they provide rationale for

my 'bounce back' opinion. Further, the anomaly offers

additional evidence which tells us NOT to expect a continuation

after the bounce back. This part of my recent study is what

prompts my reconciliation that current buyers of real estate be

warned.

Unless you engage real estate with the objective of turning it

over in 6 months, I think an investment in Real Estate is a poor

decision even in the face of the bounce back I expect. If you

are a buyer today I do think you will be happy for the next 6-12

months because pricing should improve. However, in 24 months

that all will change, in my opinion, because Real Esate prices

will fall hard yet again as demand ratios decline over the next

decade. This will adversely impact the economy, again.

I expect a Greater Depression. I expect the

United States to reach an insolvent state, and I expect the

dollar to devalue severely as the Treasury is forced to print

money to cover debt. I expect all this to come in the face of

deteriorating longer term demand trends evidenced by THE

INVESTMENT RATE. Normalized trends will surface sfter the

return to parity referenced in my Anomaly article comes full

circle.

After the immediate wave of economic drubbing subsides I expect

improvement for the next few quarters. However, the

comparison-based improved economic conditions will not last

long. The headfake will hurt many investors yet again. Do not

let it hurt you.

I expect good times for a while. Enjoy it while it lasts.

9.23.08

The economic

landscape has changed after the 'short selling debacle' caused

runs on some our nations largest institutions. The

problems stemming from the failure of the CDO - CDS markets are

becoming more and more clear. For those that don't

understand the significance, this Market was approximately $46

Trillion in 2006-2007, according to some estimates. The

Treasury is about $5 Trillion, just to offer a comparative

analysis. Translated, the economy holds a significant

amount of synthetic debt.

This is the root

of the problem in our economy right now. This is what

congress is faced with, and this is what Paulsen and Bernake are

trying to combat with their $700 Billion Proposal. This is

a byproduct of the Investment Rate by the way, and a major

variable in the probability equation of a Greater Depression, a

term we have already discussed.

First, risk

analysis tell us that the balance of risk given the $46 Trillion

synthetic debt Market vs the $700 Billion proposal is

significant. Can $700 Billion really cover the cost?

Also, many wall street pundits are asking why the Government

would acquire ownership stakes in the banks who choose to engage

the government for solvency. The answer is quite clear...

By definition

synthetic debt only holds value IF the loans are paid. If

the loans fail the portion of the bundled debt package that was

tied to the failed loan dies along with it. In many ways

this can be analogous to an expiring option. This option

just happens to pay interest. However, there is no

underlying asset!

The risk is

default.

Owners of

synthetic debt will lose all of their investment if all of the

loans in the bundle default. If only a portion default,

the losses will be limited to that portion. Although the

bundling of loans dilutes the potential for complete loss, the

risk is still very clear: The potential for 100% loss exists.

This is why the Government is proposing an option to acquire

equity in the banks who engage this program. Otherwise the

risk to the taxpayer would be 100%. Wall Street pundits,

including Larry Kudlow, need to stop balking at this.

However, that

doesn't change the bailout's efficacy.

$700 Billion

without associated risk controls is penance to the US Taxpayer.

This is the resolve of Congress, and this is where the debate

comes from. I don't blame them. I personally have a

problem putting $700 Billion of US Taxdollars in an option!

Especially in the face of the 3rd major down period in US

History, according to the Investment Rate.

The banks should

be left holding the bag....but not the banking system.

Maybe this is

where the capitalist structure really begins to work?

Maybe this is where Darwinism applied to economics becomes

relevant? Maybe this is where the potential insolvency of

the banks who own the synthetic debt becomes a reality?

Maybe this is where the shit hits the fan?

I personally feel

that Paulsen and Bernake have done a horrible job developing and

selling the proposal and although I do expect congress to pass

something to patch this immediate issue, I do not expect their

proposal to pass. Further, for Paulsen not to recognize

the significance of this issue after his tenure with Goldman

Sachs is catastrophic. He may be a true free market

capitalist, and if so he should be willing to let the banks

fail. That may be the answer...sort of....

This leads me

to my proposal.

We have already

heard the terms 'good bank' and 'bad bank,' these are excellent

terms. Unfortunately, the proposals that we have been hearing

thus far are to sell the bad banks to the US Government to get

the synthetic debt off the books, and allow the good banks to

remain in the hands of shareholders. Not so fast!!!!!!

I appreciate the

notion of good bank and bad bank because that clears up plenty

of the associated risk tied to the synthetic debt market.

However, I do not agree that the Taxpayer should buy the bad

bank to provide solvency to the underlying entity. Nor do

I want the US Government to own shares in companies they do not

control.

Instead, I

believe that the Government, where needed, should

buy the good bank instead! The

Government, for a short while, will own the solvent, operational

bank, but it will never own the synthetic debt under my

proposal.

The remaining

portion of the potentially insolvent bank owned by shareholders

and bondholders would be tied directly to the bad bank if the

entire entity needs Government assistance, and those

shareholders would bear the entire risk associated with the

synthetic debt. The government should not be willing to

buy the bad bank in any circumstance whatsoever!

Definitions of good and bad assets would have to be made clear

through policy.

In fact,

banks should be required to differentiate between good and bad

assets now, prior to the risk of insolvency. By dividing

these assets now potentially insolvent banks might also have the

ability to spin off the bad bank to shareholders, leaving them

with a significantly smaller equity percentage in the good bank

of course. This, in turn, would still leave shareholders

with some equity in the good/solvent bank, ownership of the bank

bank, and the banking system would remain in tact because the

good bank would not dissolve. The shareholders and

bondholders would remain owners of the synthetic debt.

If the Government

is forced to assume control of the good bank based on the

insolvency of the underlying entity, the US Government would

then revert the existing 'good bank,' which should be solvent

and operational, back to the public through special offerings.

This would allow the Taxpayer to recoup the expenditure and it

would put the onus of 100% loss on the 'bad bank' instead.

If those CDOs hold value, the shareholders of the bad bank

should be able to liquidate those assets for fair value in the

open Market. If they don't, the bondholders will lose

everything. But the risk will be on them, not on the

Government.

The Government

is already overleveraged.

This proposal

would require the development of new agencies and it would

require the active involvement of the Treasury in direct

connection to Wall Street to spin off these 'forced majeure'

banks. However, it would prevent Taxpayers from assuming

the risk on behalf of the banks which caused this problem in the

first place, and it would allow the banking system to remain

operational.

In the case of

bankruptcy without prior differential, the US Government would

impose a mandate to restructure the bank into 2 entities based

on policy, sell the good entity to the government, and dispose

of the bad bank in the open market under bankruptcy proceedings.

Given a declining

Investment Rate, the government should not leverage itself

without protection, and the 'bad bank' policy being proposed

does not offer any protection whatsoever while increasing the

risks measurably.

My proposal

offers protection, and it will allow the banking system to

remain in tact. My proposal pays no consideration to the

shareholders or owners of potentially insolvent banks, but

instead it focuses on the banking system itself.

Significantly lower equity values would be a natural byproduct

of my proposal, and warranted.

Paulsen and

Bernake have failed thus far.

Good Investing.

Thomas H. Kee Jr.

President and CEO

Stock Traders

Daily.

6.7.08

I continue to expect serve

recessionary and depressionary economic data within 12 months,

but I continue to believe that the economic drubbing with remain

controlled for the time being.

Oil prices are a concern, and I

expect consumers to restrain travel plans and energy

expenditures in the face of soaring energy prices.

However, I also expect alternative expenditures to prevail for

the time being. Would be travelers will, I expect, opt for

vacations much closer to home. Maybe they will opt for

summertime purchases such as barbecues, camping equipment, and

sailboats may become much more popular too. The point:

consumers will try to find alternatives which don't involve

excess energy costs.

I expect driving to be minimized,

public transit to be utilized, and flights to be forgone,

especially when family vacations are considered. From an

industry perspective I expect the travel industry to show very

weak numbers after the summer months.

However, as stated above, I d not

think that the 'drubbing' of the economy will start again

officially until the 4th quarter of the year.

In the 4th quarter I expect 2

important things to happen:

-

Wall Street will realize

that Interest rates will rise aggressively in early 2009

-

Wall Street will realize

that taxes will increase aggressively in the beginning of

2009..

Immediate conclusion:

I expect current and continued

Market volatility. I continue to promote proactive trading

strategies. Long/Short Strategies will prevail. I

expect the Market to collapse as the year comes to an end.

Until then a volatile back and

forth Market should prevail.

THK.

4.4.08

The Economy is probably in a

recession at this time. If not completely, certain sectors

undoubtedly are. We can only identify recessions after the

fact, so by the time you hear a confirmation of a recession the

Market and the Economy have probably already begun to recover.

I expect the current recessionary

environment to improve somewhat. I do not expect the

Economy to appear strong by any means, but I believe that the

drubbing the Economy has experienced over the past few months

will subside for a few months at least. This should

influence traders and investors to breathe a big sigh of relief,

and it may influence higher Market levels too.

Take it while you can get it,

because the bad news will come again. Late in the year I

expect another drubbing. By the 4th quarter of 2008 the

market should look very fragile again, and as we roll into 2009

I expect a depressionary environment to surface.

11.25.07

the Investment Rate has told us

that liquidity levels would peak at some point in 2007.

That has happened. Now, the economy is under severe

pressure. We expected this as well. This pressure is

not likely to subside anytime soon. In fact, the market is

likely to continue to be under severe pressure for the

foreseeable future. This is based on liquidity levels.

New money drives the economy and the Market, and clearly

liquidity levels have peaked and they are declining measurably.

When this happens aggressive downward moves are likely in the

market, typically in advance of worsening economic conditions.

Our economy is surely going to enter a recession and it is

likely to be quite severe. The consumer is already heading

for the exit, and the consumer drives this economy. Debate

the worldwide economy all you want, but unless our consumer

continues to actively spend money our economy is going to

fizzle. In fact, our economy, if indeed it continues to

worsen as we expect, will drive all other economies down with

it, at least for a while.

Immediately, expect the crisis in

the housing market to worsen going into 2008. Foreclosures

should start to hit the market much more aggressively in the

first quarter. Jobless rates should increase, GDP levels

should decline, the economy will fall into recession, and it

will all be lead by the consumer. In addition, we should

expect tax rates to increase after the election, and that will

only add to the pressures on the market.

Foreign interest in US

investments should also be extremely weak. Yes, there is a

glut of cash available for investment from foreign investors,

but most of them are targeting international investments in Asia

and Europe rather than in the United States. From the

standpoint of foreign investors, the problems in the United

States are going to worsen, and they are the root of the

problems that may adversely affect other markets as well.

Obviously smart money is looking for opportunity, but with the

continued decline in the dollar, the return from any equity

investment in the United States will be offset by the continued

slide in our currency. The net rate of return for foreign

investors therefore is substantially lower than it might be in

other foreign investments. We cannot expect foreign

investors to hold this market up. Though the dollar is

low, the net rate of return is poor.

Ultimately, our economy is on the

brink of a very bad recession. The stock market, housing

market, the consumer, financial stocks, now technology, are all

offering red flags. That, coupled with the findings of the

Investment Rate, tell us that liquidity issues abound. The

market has followed the Investment Rate perfectly since 1900,

and it tells us that the market is on the brink of the third

major down period in US history. Holding assets at this

time is a big mistake. Buy and hold strategies, the Warren

Buffet style, although very attractive over long periods of

time, do encounter bumps in the road. Buying and holding

from the peak of the third major down period in US history

should be considered such a bump. If you bought and held

at the beginning of the first major down period you lost 75% of

your assets and it took 26 years for you to get whole. If

you did it during the second major down period you lost 50% of

your assets and it took 10 years to get whole. If you have

the time, and you are willing to stomach the loss, then buy and

hold strategies may work for you. Otherwise, reverting to

cash and looking for opportunities again when the declines are

over makes a considerable amount of sense. The economy is

going to get much worse.