|

Summary:

Expect the Market to begin the day with a bias

to increase on Friday.

HEADS UP

(written before Monday and intended for the

entire week):

The Market is

retracing back to recent lows. The

question on everyone's mind is, will it continue

to decline this time? At first glance,

Friday was a knee jerk reaction, but everyone

seemed lined up to sell again. Will this

be a story that we here over and over again.

Will every bounce be met with sellers? If

so, the Market is likely to decline

substantially from current levels over time.

Technical

Analysis

|

Near Term Outlook

|

Our combined

near-term analysis tells us the market is in a near-term neutral trading

channel. In addition, it tells us that the market has recently broken

above the neutral intra-channel resistance line that had been in tact.

This former level of resistance has since been converted into support and it is

inflection. If recently converted near term neutral intra-channel support

remains in tact expect the market to begin the day with a bias to increase on

Friday and expect a test of near term neutral resistance to follow.

|

|

Mid Term Outlook |

Our combined midterm

analysis tells us that the neutral mid term channel that

we have been watching is likely to solidify soon.

Specifically, midterm neutral resistance is likely to be

tested soon, and that will confirm the channel again.

According to our combined midterm analysis, support

levels have held thus far. If those support levels

continue to hold, and because the market has already

begun to pull away, expect a test of resistance to

follow. Appropriately, our combined midterm

analysis tells us to expect a test of midterm neutral

resistance levels soon. If/when that happens,

treat resistance as inflection.

|

|

Long Term Outlook |

Our combined longer term

analysis tells us that the Market is threatening to

break longer term neutral support. This, when

combined with the reversal confirmation we pinpointed in

late April, suggests that aggressive breaks are likely

at some point. Treat support as inflection,

recognize that some markets have started to break below

longer term neutral support already, and prepare for

additional declines at some point as a result. A

slight bounce back is not uncommon, but the breach that

is obvious from some of the Markets we follow suggests

that an eventual turn lower should come. This sets

the stage for our longer term plans.

Special reports:

1. April 2010 - The

Reversal Confirmation

http://www.stocktradersdaily.com/may.htm

2. Game Plan

http://www.stocktradersdaily.com/short conversion2.pdf

3. 2010 - The Year of the increase:

http://www.stocktradersdaily.com/reports/2010.pdf

Dow parameters for Strategic Plan:

6485 - 9083 - 9904 - 10725 - 11724

|

YTD Return: |

Strategic |

Plan = |

39.12% |

Investment Rate:

We are long term Bears. We expect a GREATER DEPRESSION in

the next 5 - 10 years. The Investment Rate explains why. Find the

link in the Main Menu of our Members Area.

|

|

Combined

Analysis: We review the charts of all

major Markets for near, mid, and long

term catalysts. |

|

NASDAQ |

SP 500 |

DOW JONES |

Summary:

Friday's

analysis:

our combined

analysis for Friday tells us to expect the

market to begin the day with a bias to increase.

Overall, our combined analysis is bullish.

The longer-term charts are bullish, midterm

support levels have held, and the near-term

charts shows is that breakouts have already

begun to occur. Combined, there is a

bullish read stemming from our analysis for

Friday. If the market begins the day with

a bias to increase and if it holds above initial

support levels, aggressive market increases can

follow. At least, midterm neutral

resistance levels can be tested. If this

occurs it should be considered a test of

inflection, but midterm resistance is nicely

higher than the close of the market on Thursday,

so such a move would also be construed as

relatively bullish. Treat initial support

as inflection for Friday's trading session, and

use it to guide your decisions accordingly.

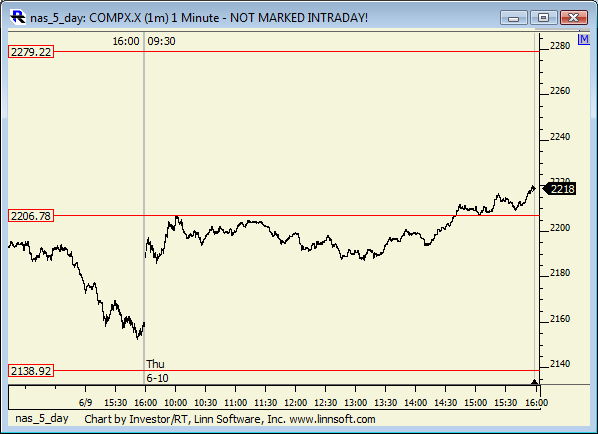

If 2207 remains in tact as support expect the

market to increase to 2279. However, if

2207 breaks lower, expect 2141 instead.

Performance Records: This

will be updated weekly, usually on Sundays.

These are all realized returns. They do

not include paper gains.

|

Updated weekly. Last update: 5.31.10 |

|

STRATEGY |

2008 Results |

2009 Results |

2010 YTD |

Long/Short? |

Risk Control? |

|

Strategic Plan |

19.17% |

31.73% |

32.39% |

Yes |

Yes |

|

Day Trading Alerts * |

129.44% |

2.99% |

23.47% |

Yes |

Yes |

|

Swing Trading Alerts * |

96.52% |

24.36% |

11.07% |

Yes |

Yes |

|

Stock of the Week |

84.40% |

13.01% |

13.28% |

Yes |

Yes |

|

Lock and Walk * |

n/a |

-11.74% |

15.20% |

Yes |

Yes |

|

Position Trades* |

|

58.70% |

19.95% |

Yes |

Yes |

|

DJIA |

-33.80% |

18.73% |

-2.80% |

No |

No |

Traders

Psychology

Traders are

opened eyed, and net buyers.

Economic

Reports

|

Jun 11 |

8:30 AM |

Retail Sales |

0.3% |

|

Jun 11 |

8:30 AM |

Retail Sales

ex-auto |

0.1% |

|

Jun 11 |

9:55 AM |

Mich

Sentiment |

74.8 |

|

Jun 11 |

10:00 AM |

Business

Inventories |

0.5% |

|

Potential

Market Moving Events

Market

Timing/Trading Approach:

We are Expert Market Timers. This

requires attention to strategy. We

offer 5 Strategies that encompass our Market

Timing Skills. These Strategies range

from Timing Strategies with 1-3 month

durations to Timing Strategies which open

and close the same day. Review our

Strategies to find the one (s) best suited

for you, and take our Boot Camp to jump

start your learning curve.

Day

Trading Results for the last session:

We issue accuracy ratings for the Day

Trading Parameters that we have provided for

the NASDAQ every day to evaluate if the

Trading Parameters that were offered for the

previous session helped us profit from day

trades. 1 = accurate (The

parameters helped us profit). 0 = Not

accurate (The parameters did not help us

profit

Accuracy Rating for the last trading

session: 0 = not Accurate

There were no

triggers on Thursday.

|

Initial

intraday trading parameters for the NASDAQ

exist between 2141 -

2209 |

|

If

2141 breaks lower expect

2059 |

|

If

2209 breaks higher expect

2304 |

|

Otherwise

expect 2141 - 2209

to hold |

|

2209 was

mid channel at the end of the day, but

it held early.

Good Trading,

Thomas

H. Kee Jr.

|