This lesson is designed to teach you how

to find Day Trades using our system. This lesson

will incorporate the instructions already provided in

lessons 1-5 and it should allow you to start to acquaint

yourself with the efficacy of our system.

All of our Trading Recommendations are

based on appropriate Market Timing. We NEVER trade

unless the Market is telling us to do so. Therefore,

in order to find Day Trades we must first follow these

simple steps:

You'll be happy to know that....

All you need to do is to watch the Market,

and to execute your trades when you are alerted to do

so. Let's take this step-by-step:

We first need to know when to execute

our Day Trades. This is exactly what the Day Trading

Parameters provide us. These Parameters are found

on the Day Trading Analysis Page referenced in the previous

lesson. Remember the link:

http://www.stocktradersdaily.com/clubsite/Club/

In the Day Trading Analysis Page specific support and

resistance Parameters are provided to you. When

one of those Parameters is tested, a trading signal

occurs. When a trading signal occurs, we are alerted

to execute trades.

Let's use a specific example. The

following Parameters are provided in a typical format;

take a look:

Initial Day Trading Parameters

for the NASDAQ exist between 2001 - 2020

If 2001 breaks lower

expect 1975

If 2020 breaks higher

expect 2045

Otherwise expect 2001

- 2020 to hold

From there Parameters we

can assume a few things:

-

We will close any trade

we make based on these parameters during the same

session we initiated it in. This is because

these are Day Trading Parameters and they are designed

to be used intraday only.

-

We can assume that

the Market was somewhere between initial support

and initial resistance when these Parameters were

published. This lies somewhere between 2001

and 2020 in this example.

-

We can assume that

the Market will either head higher and test resistance

first, or it will decline towards support.

In either case we need a plan

TRADING PLANS

There are 2 types of plans.

Each of the plan types have a series of dynamic possibilities,

which should be rather obvious. These possibilities

will be discussed in detail for each plan type.

Here are the initial plan types:

-

Support Plans

-

Resistance plans.

If the support level is

tested first the Market could either hold support, or

support could break. If the resistance level is

tested first, resistance could either hold or break.as

well. However, upon each test, and each subsequent

break, trading signals occur. Let's take a look

at the support plans:

If support is tested first

a trading trigger occurs which recommends a long trade.

This is SUPPORT MODE. Support Mode occurs

as soon as a support level is tested. By rule,

an official test of support comes when the Market is

within 3 points of stated support.

Once in Support Mode, 2

things can happen.

-

Support can hold.

-

Support can break.

If Support holds, the trading

plan is simple:

-

Buy near support, target

resistance. In our example that would be:

Buy near 2001, target 2020. (Near means within

3 points, so 2004).

If support breaks a second

trading trigger occurs.

-

If a level of support

breaks, a trading trigger comes which recommends

a short position for balance. Balance means

that there is 1 open long position and 1 open short

positions at the same time. Balance is required

because the Market is threatening a break of support

in this instance. When balance is required

after a support level is tested, we consider the

Market to have triggered SUPPORT BALANCE MODE.

-

Immediately after the

Market gets into Support Balance Mode the 5-point

rule should be implemented. This tells us

to overweight longs or shorts if the Market moves

5 points away from our Parameter. Here's an

example using the sample Parameters above:

Let's assume the Market tests support at 2001 first.

This would mean that a long signal occurred.

However, let's assume that 2001 broke slightly lower.

This would require balance, and the 5-point rule

would be implemented. Because 2001 was our

Parameter, if the Market moved to 2006 after having

balance we would overweight longs (2 longs and 1

short). However, if the Market moved down

instead and breached 1996 we would have a signal

to overweight shorts (2 shorts 1 long).

If we are in an overweight

short position (2 shorts 1 long) we are considered to

be in a SUPPORT BALANCE SHORT MODE. In

this mode we should be expecting the shorts that were

triggered to work for us as the Market declines to the

next lower level of support. In our example we

would have a trading plan as follows: Overweight

shorts under 2001 target 1975.

If we are in an overweight

long position (2 longs 1 short) we are considered to

be in a SUPPORT BALANCE LONG MODE. In this

mode we should be expecting the Market to increase to

the next level of resistance. In our example that

would be 2020. In our example we would have a

trading plan as follows: Overweight longs above

2001 with a target of 2020.

In support balance short mode 2 things

can happen:

-

The Market can test

the next level of support. If the Market tests

the next level of support, our downside target will

have been reached and we should close all trades

and start over. We would expect to make money

from 2 shorts and we should expect to have had 1

stop from the long which was initiated for balance.

-

The Market could turn

higher. If the Market turns higher and triggers

the 5 points rule on the upside too (after having

already done so on the downside), the Market goes

into SUPPORT BALANCE SHORT LONG MODE

In Support balance short

long mode the Market will either decline to the next

lower stated levels of support, or the market will increase

to the next higher level of resistance. In either

case, no more positions will be initiated until one

or more of the current positions are closed. In

this instance we would have 2 longs and 2 shorts at

once. Therefore there would be 4 trades called

at the same time. This is our position limit.

We will never have more than 4 positions called at once.

Expected results after

being in Support Balance Short Long Mode:

-

If the next level of

support is tested first we would expect to lock

in gains from the shorts that were in place, but

we could also expect the stops that occurred from

the 2 longs that were in place to offset those gains

somewhat.

-

If the next level of

resistance is tested first we would expect to lock

in gains from the 2 long positions that were in

place, but we could also expect to have those increases

offset somewhat from the 2 shorts that were in place

for balance.

-

In either case, after

these positions are closed, we should look for new

trading ideas based on the Parameters that have

been provided for that session.

Take a look at this graphic

for an easy to understand interpretation:

In support balance long mode 2 things

can happen as well:

-

The Market can test

the next level of resistance. If the Market

tests the next level of resistance, our upside target

will have been reached and we should close all trades

and start over. We would expect to make money

from 2 longs and we should expect to have had 1

stop from the short which was initiated for balance.

-

The Market could turn

lower instead. If the Market turns lower and

triggers the 5 points rule on the downside too (after

having already done so on the upside), the Market

goes into SUPPORT BALANCE LONG SHORT MODE

In Support balance long

short mode the Market will either decline to the next

lower stated levels of support, or the market will increase

to the next higher level of resistance. In either

case, no more positions will be initiated until one

or more of the current positions are closed. In

this instance we would have 2 longs and 2 shorts at

once. Therefore there would be 4 trades called

at the same time. This is our position limit.

We will never have more than 4 positions called at once.

Expected results after

being in Support Balance Long Short Mode:

-

If the next level of

support is tested first we would expect to lock

in gains from the shorts that were in place, but

we could also expect the stops that occurred from

the 2 longs that were in place to offset those gains

somewhat.

-

If the next level of

resistance is tested first we would expect to lock

in gains from the 2 long positions that were in

place, but we could also expect to have those increases

offset somewhat from the 2 shorts that were in place

for balance.

-

In either case, after

these positions are closed, we should look for new

trading ideas based on the Parameters that have

been provided for that session.

The 2 graphs below may

help you better understand these concepts. The

first graphic shows you the breakdown of Support Balance

Short Mode. The Second shows a breakdown of Support

Balance Long Mode:

Take a look at this graphic

for an easy to understand interpretation:

The illustrations above walk you through

support mode. However, we still need to address

resistance mode. Basically this will be the opposite

of support mode.

If resistance is tested

first a trading trigger occurs which recommends a short

trade. This is RESISTANCE MODE.

Resistance Mode occurs as soon as a resistance level

is tested. By rule, an official test of resistance

comes when the Market is within 3 points of stated resistance.

Once in Resistance Mode,

2 things can happen.

-

Resistance can hold.

-

Resistance can break.

If Resistance holds, the

trading plan is simple:

-

Short near resistance,

target support. In our example that would

be: Short near 2020, target 2001. (Near

means within 3 points, so 2017).

If resistance breaks a

second trading trigger occurs.

-

If a level of resistance

breaks, a trading trigger comes which recommends

a long position for balance. Balance means

that there is 1 open short position and 1 open long

position at the same time. Balance is required

because the Market is threatening a break of resistance

in this instance. When balance is required

after a resistance level is tested, we consider

the Market to have triggered RESISTANCE BALANCE

MODE.

-

Immediately after the

Market gets into Resistance Balance Mode the 5-point

rule should be implemented. This tells us

to overweight longs or shorts if the Market moves

5 points away from our Parameter. Here's an

example using the sample Parameters above:

Let's assume the Market tests resistance at 2020

first. This would mean that a short signal

occurred. However, let's assume that 2020

broke slightly higher. This would require

balance, and the 5-point rule would be implemented.

Because 2020 was our Parameter, if the Market moved

to 2025 after having balance we would overweight

longs (2 longs and 1 short). However, if the

Market moved down instead and breached 2015 we would

have a signal to overweight shorts (2 shorts 1 long).

If we are in an overweight

short position (2 shorts 1 long) we are considered to

be in a RESISTANCE BALANCE SHORT MODE. In

this mode we should be expecting the shorts that were

triggered to work for us as the Market declines to the

next lower level of support. In our example we

would have a trading plan as follows: Overweight

shorts under 2020 target 2001.

If we are in an overweight

long position (2 longs 1 short) we are considered to

be in a RESISTANCE BALANCE LONG MODE. In

this mode we should be expecting the Market to increase

to the next level of resistance. In our example

that would be 2045. In our example we would have

a trading plan as follows: Overweight longs above

2020 with a target of 2045.

In resistance balance short mode 2

things can happen:

-

The Market can test

the next level of support. If the Market tests

the next level of support, our downside target will

have been reached and we should close all trades

and start over. We would expect to make money

from 2 shorts and we should expect to have had 1

stop from the long which was initiated for balance.

-

The Market could turn

higher. If the Market turns higher and triggers

the 5 points rule on the upside too (after having

already done so on the downside), the Market goes

into RESISTANCE BALANCE SHORT LONG MODE

In Resistance balance short

long mode the Market will either decline to the next

lower stated levels of support, or the market will increase

to the next higher level of resistance. In either

case, no more positions will be initiated until one

or more of the current positions are closed. In

this instance we would have 2 longs and 2 shorts at

once. Therefore there would be 4 trades called

at the same time. This is our position limit.

We will never have more than 4 positions called at once.

Expected results after

being in Resistance Balance Short Long Mode:

-

If the next level of

support is tested first we would expect to lock

in gains from the shorts that were in place, but

we could also expect the stops that occurred from

the 2 longs that were in place to offset those gains

somewhat.

-

If the next level of

resistance is tested first we would expect to lock

in gains from the 2 long positions that were in

place, but we could also expect to have those increases

offset somewhat from the 2 shorts that were in place

for balance.

-

In either case, after

these positions are closed, we should look for new

trading ideas based on the Parameters that have

been provided for that session.

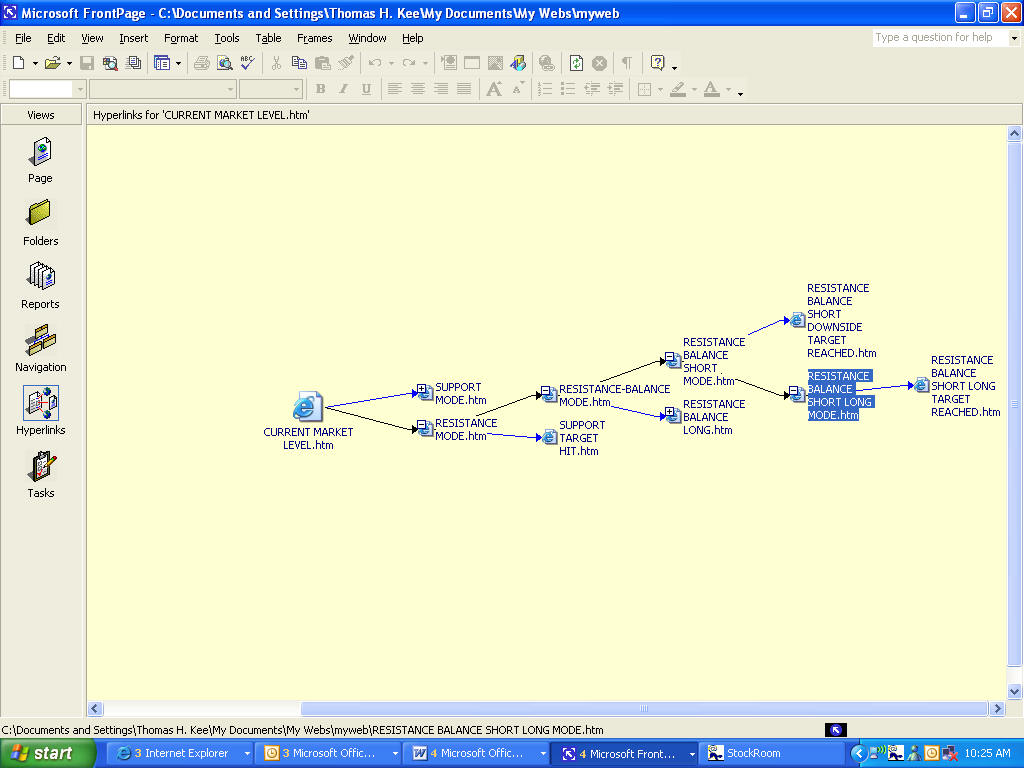

Take a look at this graphic

for an easy to understand interpretation:

In resistance balance long mode 2 things

can happen as well:

-

The Market can test

the next level of resistance. If the Market

tests the next level of resistance, our upside target

will have been reached and we should close all trades

and start over. We would expect to make money

from 2 longs and we should expect to have had 1

stop from the short which was initiated for balance.

-

The Market could turn

lower instead. If the Market turns lower and

triggers the 5 points rule on the downside too (after

having already done so on the upside), the Market

goes into RESISTANCE BALANCE LONG SHORT MODE

In Resistance balance long

short mode the Market will either decline to the next

lower stated levels of support, or the market will increase

to the next higher level of resistance. In either

case, no more positions will be initiated until one

or more of the current positions are closed. In

this instance we would have 2 longs and 2 shorts at

once. Therefore there would be 4 trades called

at the same time. This is our position limit.

We will never have more than 4 positions called at once.

Expected results after

being in Resistance Balance Long Short Mode:

-

If the next level of

support is tested first we would expect to lock

in gains from the shorts that were in place, but

we could also expect the stops that occurred from

the 2 longs that were in place to offset those gains

somewhat.

-

If the next level of

resistance is tested first we would expect to lock

in gains from the 2 long positions that were in

place, but we could also expect to have those increases

offset somewhat from the 2 shorts that were in place

for balance.

-

In either case, after

these positions are closed, we should look for new

trading ideas based on the Parameters that have

been provided for that session.

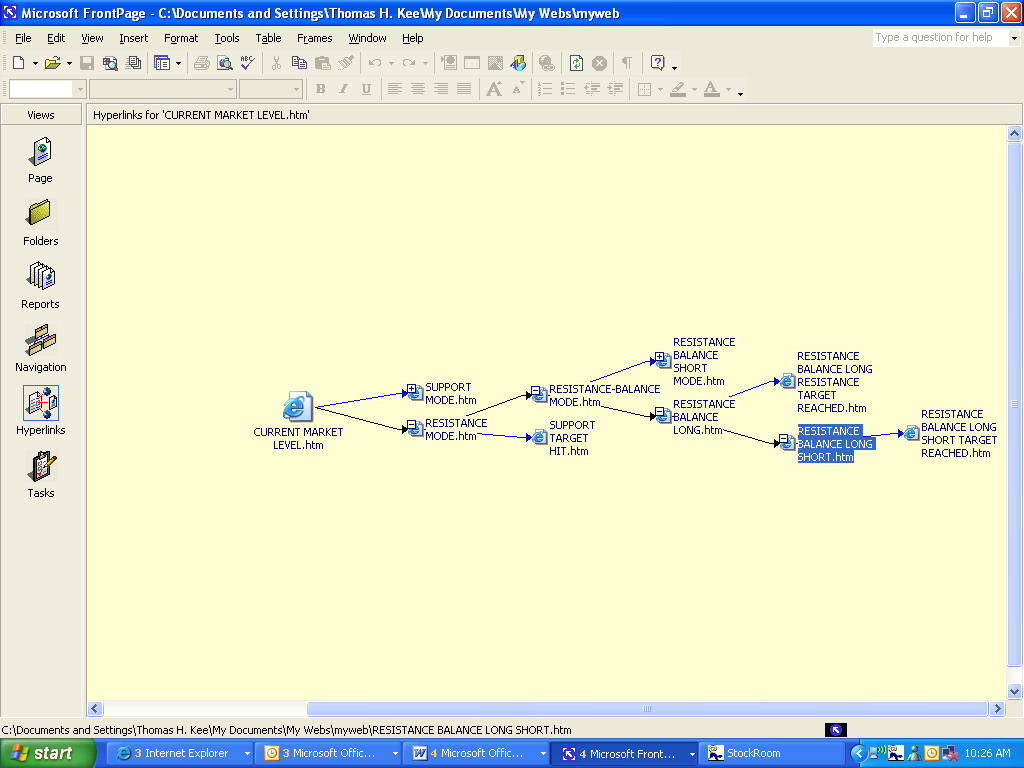

Take a look at this graphic

for an easy to understand interpretation:

This lesson tells you when trades

are triggered. The next lesson will tell you how

to find trades once a trigger occurs.

If you do not understand when trades are

triggered, please review this lesson.