|

Our trading

strategies focus on discipline and risk control.

We offer automated

and correlated trading strategies and real time

trading reports on individual stocks.

We consider our

strategies to be similar to the Tortoise in the

race with the Hare. We do not design them

for home runs, but rather to take advantage of

small gains regularly; they incorporate strict

risk controls. We are satisfied taking

small gains all the time so long as we remain in

control of our risk at all times.

There's no reason

to subject ourselves to excessive risk, so we

don't recommend it. The end result, we are

also always in the game, and that is the name of

the game.

Topics:

-

Individual

Stock Reports

-

Intelligent

Alerts Viewer

-

Automated

Trading Program

-

Give it a Try

Individual Stock

Reports

We offer real time

trading reports on 1300 different Stocks.

Trading plans are

included for day trades, swing trades, and long

term trades.

These reports are

unbiased. Each report includes trading

plans for longs and for shorts. The

reports do not tell you to buy or to short, but

if you know how you want to trade the stock

before you review the report, our reports will

tell you exactly where to enter the trade, where

your price target should be, and where your stop

loss should be placed.

For example, if you

knew that you wanted to buy AAPL, you could use

our AAPL report to help you determine exactly

where you should buy the stock.

These reports are

an integral part of our Intelligent Alerts Viewer (read

below).

We also use them

for other purposes:

Here's an example

of our reports:

|

Example

from 9.17.07

BRCM

(BROADCOM CORP CL A)

Recently trading at: 34.85

September 17, 2007, 9:43 pm

ET

Refresh to update stock values

|

Trading Plans

for BRCM |

|

Day Trading Plan

|

|

Swing Trading

Plan |

|

Long Term

Trading Plan

|

|

|

|

Technical Summary |

| |

Near Term

|

Mid Term

|

Long Term

|

|

Directional Bias

|

Neutral

|

Strong |

Neutral |

|

Parameter 1 |

34.81

|

33.43 |

22.88 |

|

Parameter 2 |

35.49

|

35.59

|

34.18 |

|

Parameter 3 |

36.23

|

37.75

|

46.30

|

|

Parameter 4 |

|

|

|

If you were to click on one of the Trading Plan links above you would

reeive trading plans for that term.

Here's an example of the day trading

plan for BRCM for 9.17.07:

|

|

Day Trading

Plans for BRCM |

September 17,

2007, 9:45 pm.

|

The slope of the near

term analysis for BRCM

is strong, the slope of

the mid term analysis

for BRCM is neutral, and

the slope of the longer

term analysis for BRCM

is neutral. When

combined with the

Technical Summary for

BRCM, this directional

analysis helps us

understand how we should

be trading BRCM. The

following trading plans

were derived using this

data and they tell you

how to trade the stock.

However, they do not

tell you whether you

should buy or short the

stock. You need to know

that before you trade.

If you do not know

already, our Market

analysis will help you

make long or short

decisions.

| Technical

Summary: ,

22.88, 33.43,

34.18, 34.81,

34.85 ,

35.59, 36.23,

37.75, 46.30,

Where 34.85 =

the recent price

|

(Long) Resistance Plan:

Buy over 35.59,

target 36.23, Stop Loss

@ 35.38

If 35.59 begins to break

higher, the technical

summary data will

suggest a buy of BRCM

over 35.59, with an

upside target of 36.23.

The data also tells us

to set a stop loss @

35.38 in case the stock

turns against us. 35.59

is the first level of

resistance above 34.85 ,

and by rule, any break

above resistance is a

buy signal. In this

case, resistance 35.59

would be breaking

higher, so a buy signal

would exist.

(Long) Support Plan:

Buy near 34.81,

target 35.59, Stop Loss

@ 34.6

The technical summary

data tells us to buy

BRCM near 34.81 with an

upside target of 35.59.

This data also tells us

to set a stop loss @

34.6 to protect against

excessive loss in case

the stock begins to move

against the trade. 34.81

is the first level of

support below 34.85 ,

and by rule, any test of

support is a buy signal.

In this case, support

34.81 would be being

tested, so a buy signal

would exist.

(Short) Resistance Plan:

Short near 35.59,

target 34.81, Stop Loss

@ 35.8

The technical summary

data is suggesting a

short of BRCM if it

breaks below 35.59 with

a downside target of

34.81. We should have a

stop loss in place at

35.8 though in case the

stock begins to work

against the trade. By

rule, any break below

support is a short

signal. In this case, if

resistance 35.59 is

breaking lower, a short

signal would exist.

(Short) Support Plan:

Short under 34.81,

target 34.18, Stop Loss

@ 35.02

The technical summary

data is suggesting a

short of BRCM if it

breaks below 34.81 with

a downside target of

34.18. we should also

have a stop loss in

place at 35.02 according

to the data. 34.81 is

first level of support

below 34.85 , and by

rule, any break below

support is a short

signal. In this case, if

support 34.81 is

breaking lower, a short

signal would exist.

Please Note: The Trading Plans listed above are based on real

time stock prices.

However, as time goes by

prices change, so please

refresh your request if

you delay your

decisions, because as

the Market moves, these

Trading Plans may

change. They are dynamic

and they change as the

market changes so they

are only valid at or

near the time you

request them. |

|

|

We use our

reports for our Focus List...

Focus List.

Our Focus List is made up of about 100 Stocks

which we have pre-qualified as good trading

candidates. These are not the hot stocks

of the day, rather they are the stocks which

tend to move with the market when the market

moves. They have high levels of liquidity,

so it is easy to get in and out of them; they

are more stable than story stocks. We

provide trading reports for each member of our

Focus List, just like we do all the other stocks

we follow.

We use our reports

for our Stock Filters...

Stock Filters.

We offer filters in association with our Focus

List which will allow you to identify, at any

given time, day trading, swing trading, and long

term trading opportunities based on the trading

reports we have created for our Focus List.

Here's an example

of our filters (we have day, swing, and long

term filters):

| Example from 9.17.07

Filters

|

Day Trading Suggestions

|

Short Day Trading Ideas Near

Resistance

| MMM |

Short under 88.99, target

88.58, Stop Loss @ 89.2

(Resistance Plan)

|

| LLTC |

Short under 34.49, target

34.11, Stop Loss @ 34.7

(Resistance Plan)

|

| FDX |

Short under 108.11, target

106.87, Stop Loss @ 108.32

(Support Plan)

|

| MXIM |

Short under 29.03, target

28.53, Stop Loss @ 29.24

(Resistance Plan)

|

| CAT |

Short under 73.82, target

72.65, Stop Loss @ 74.03

(Resistance Plan)

|

The

entire list contains 30 stocks orders

from nearest to furthest from their

respective parameters. In this

case the list is orders from nearest to

furthest away from resistance.

|

We use our reports

for our Featured Stock Recommendation...

Featured Stock

of the Day. We use our trading reports

in conjunction with the filters mentioned above

and our Market Analysis to offer a single

trading recommendation every day. The

stock we choose is called our Featured Stock of

the Day. This stock is designed to work

with the Market Analysis we provide for the

trading session in question. For example,

if we expect the market to test resistance and

turn lower, we filter the Focus List for stocks

likely to test resistance at the same time the

Market does, and we would select a stock to

short from that list; the stock we select would

be our Featured Stock of the Day.

Here's an example

of a Featured Stock Recommendation:

| Example from 9.17.07

United Technologies (UTX). Short

UTX between 76.11 and 76.06. Target

75.01. If you are triggered set a stop

loss at 76.32 to protect your position.

In addition, if the stock triggers as

indicated above and then moves into the

money by $0.35 set a $0.10 trailing

profit stop to secure a gain from the

trade. Specifically, if the stock gets

to 75.76 set a trailing $0.10 profit

stop at 75.86 and let the protectionist

trailing profit stop ride as the stock

moves. Using this approach will allow

you to get more out of the trade and it

will force you to protect your position

too. If you are stopped you should be

willing to re-enter the trade. Limit

your # of trades to 3 though. Don't

trade it more than 3 times with both

stops and profits included. No matter

what, end the day in cash. |

Intelligent

Alerts Viewers:

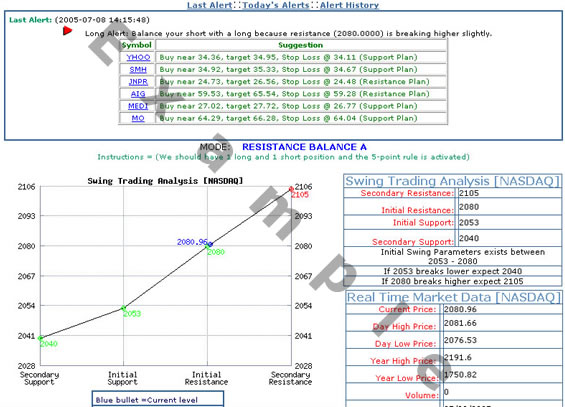

We have created an

Alerts Viewer which is intelligent, which knows

where the support and resistance levels that we have identified

for the Market exist,

and which automatically alert you (with a

series of beeps) to any test of support or

resistance when it occurs.

The Alerts Viewer

acts as a resource to traders who want alerts

when tests of support or resistance levels

happen, but who might not be able or willing to

sit back and watch the Market tick by tick.

These alerts

include correlated trading recommendations as

well. When an alert is fired the program

filters our Focus List for stocks which are

trading with the Market, so you have a high

probability of identifying stocks which are

going with the flow.

If, for example,

the Market tests a support level an alert fires

which includes 5 stocks which are trading at

their respective support levels at the same

time. Therefore, the trading

recommendations offered in the alert correlate

with the market based on the Timing parameters

that we provide.

All you need to do

is open the page, minimize it on your computer,

and make sure your sound is on. The

web-based program will do the rest. Wait

for an alert, pick one of the stocks on the

list, and execute your trade.

Find an example

here, then review the terms below:

Automated Trading Program:

This is the first

completely automated trading program on the

market.

This is also known

as our ATAP Program. The explanation for

this program is included in a section of its

own. Read the complete description of the

ATAP Program by clicking the

ATAP link on the left side of this page.

Give it a try:

|

|

Free 10

Day Trial - Platinum Membership

Sign Up Now

You can cancel at any time and won't be charged

All of our services are

included in the Free Trial.

Instructions:

- Click the Sign Up Link below to start your Free Trial

- Record your username and password.

- Use the Platinum Login to enter the Clubsite.

- Your Free Trial lasts for 10 Calendar Days

- The service is $299 per month after 10 Days.

|

|

|